The Latin American insurance market in 2020

Author: MAPFRE Economics

Summary of the report’s conclusions:

MAPFRE Economics

The Latin American insurance market in 2020

Madrid, Fundación MAPFRE, September 2021

In October 2021, the International Monetary Fund (IMF) raised the full-year economic growth forecast for Latin America to 6.3% (compared to a 7% decrease in 2020), half a point above the forecast it announced in July, due mainly to the strong performance of oil, mineral and other raw material exports. This return to economic growth is also based on the reactivation of investments and external demand, underpinned by the recovery of the world’s two largest economies, the United States (a major source of remittances) and China, its two main trading partners. The recovery in domestic consumption has also helped, but to a lesser extent while the job market remains below pre-crisis levels, which has exacerbated the region’s endemic problems with low employment and productivity levels. On the other hand, inflation is rising and should close the year at an average of 9.7% (6.3% in 2020), coupled with the significant increase in fiscal deficits and debt-to-GDP levels in most of the region’s economies.

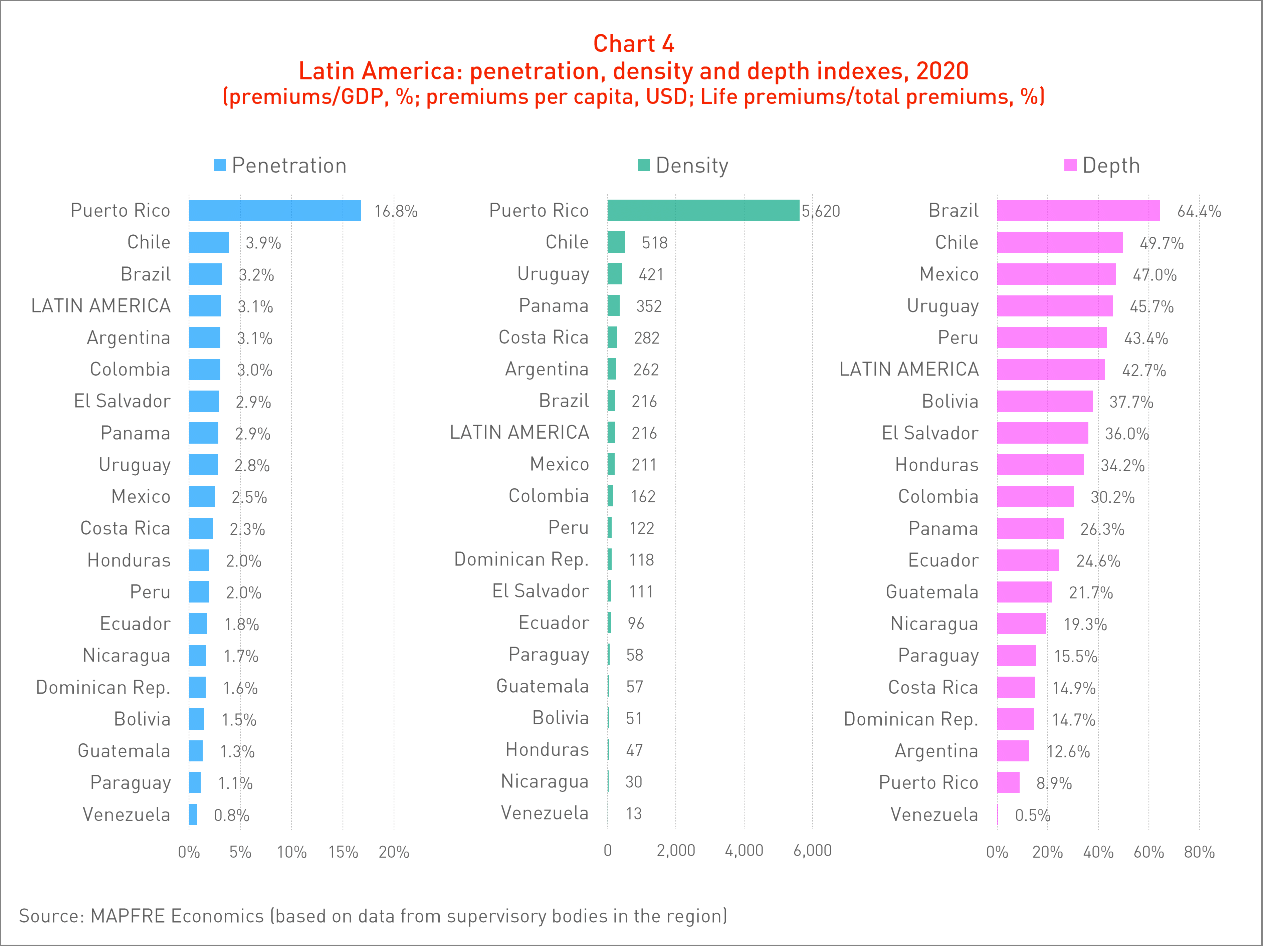

The return to economic growth in Latin America and the Caribbean in 2021 is contributing to the recovery of their insurance markets, which fell sharply the previous year due to the severe economic crisis caused by the pandemic. Total insurance premiums amounted to $134.36 billion in 2020, down by 11.9%, largely due to the contraction of the Life business and amplified by the marked depreciation in exchange rates in the major markets. Premiums in the Life insurance segment thus fell sharply, dropping 18.7% in dollar terms (compared to 5.0% growth in 2019), while premiums in the Non-Life insurance segment dropped 6.1%, compared to a 1.7% decrease in 2019 (see Chart 1).

In general, Life insurance was severely affected in 2020 by the ultra-accommodative monetary policy implemented by central banks across the region (with deep cuts in interest rates, among other measures). This complicated the Life savings and annuity insurance business, as the guaranteed return on marketed products had to be significantly reduced. Adding to this situation were the abrupt contraction in the economy and the movement to cash that occurs at times of high uncertainty, when economic players prefer to keep their savings in sight rather than entering into other types of medium or long-term investments (as has been the case during this crisis). The sharp decline in the Life business in Brazil, Mexico, Chile and Colombia in 2020 largely explained the marked downturn in this line of business at an aggregate level in the region.

However, in 2021 the increase in inflation is forcing most central banks to tighten their monetary policies, raising interest rates. This is encouraging the recovery of the Life business, which is showing strong growth in the region’s main markets (including Brazil, Mexico, Colombia and Peru) in a context of higher demand for financial products that help savers to protect themselves from the loss of purchasing power due to rising inflation.

Meanwhile, the Non-Life segment in Latin America and the Caribbean in 2020 performed in line with this business segment in other parts of the world, with a significant decline in business volume in Auto insurance (representing 16.2% of the region’s total premiums). This was partially offset by the Health business (representing 15% of total premiums), which is performing in a countercyclical manner, as is usual in major economic crises and particularly in this health crisis. In 2021, the return to economic growth in the region is encouraging the Non-Life business’ recovery on an aggregate level.

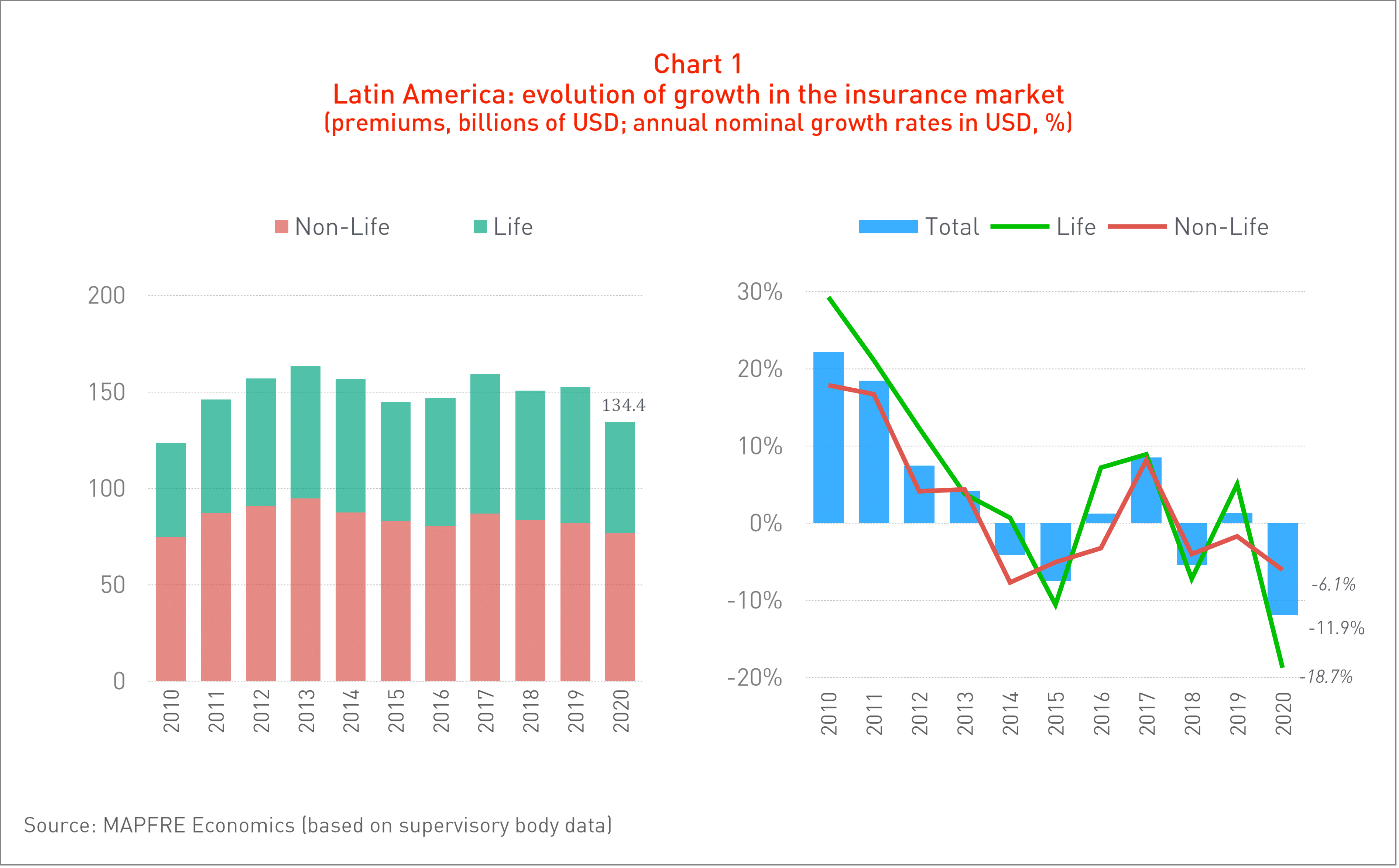

Analyzing the performance of insurance business premiums in the local currencies of the respective markets (corrected for inflation), real declines were observed in 2020 in virtually all the region’s major insurance markets (see Chart 2). The sharpest decreases were found in the Chilean market (-15.3%), followed by Ecuador (-5.3%), Mexico (-3.1%), Peru (-2.4%) and Brazil (-2.0%). However, some exceptions were observed, such as the significant growth in Puerto Rico (13.7%), due to the strong performance of health insurance, and Argentina (10.4%), although in the latter case, the transition to inflation accounting caused distortions in the comparison. The other markets that showed growth (El Salvador, Uruguay, Bolivia, Guatemala, the Dominican Republic and Costa Rica) experienced a marked slowdown. The sole exception was Paraguay, which showed real growth of 3.2% (this was one of the economies that were least affected by the pandemic).

In terms of profitability, in 2020, the aggregate net result of the Latin American insurance market stood at 9.32 billion dollars, down by 30.1% compared to the aggregate result of 2019 and breaking the growth trend observed in recent years. Thus, with the exception of Chile, Costa Rica, Guatemala, Paraguay, Puerto Rico and Uruguay (where profits grew), profit in dollars decreased in the region’s markets compared to the previous year. This was strongly influenced by the depreciation of exchange rates along with factors related to their technical and/or financial profitability, as they all showed declines in terms of return on equity as well.

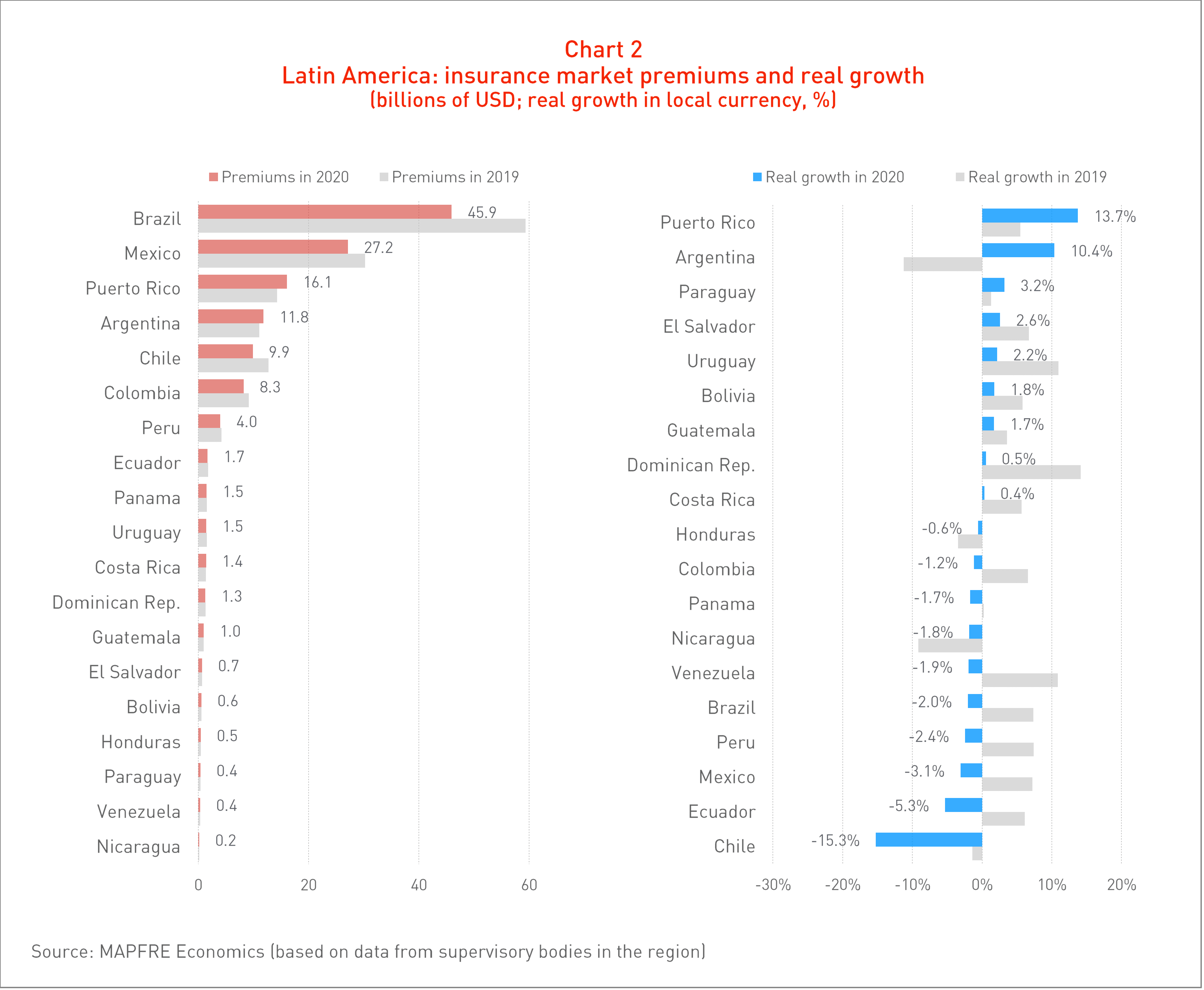

Among the structural trend indicators, the average penetration index (premiums/GDP) of the region’s insurance industry stood at 3.1% in 2020, higher than the previous year’s index by 0.17 percentage points (pp). The indicator improved in the Non-Life segment (1.8%, compared to 1.6% in the previous year) and worsened in the Life segment (1.3%, compared to 1.4% in the previous year), contrary to previous years, when the improvement came from the Life segment, which is less developed in the region. This is an atypical situation, and it was undoubtedly based in part on the strong contraction in GDP caused by the pandemic during 2020, as well as the resistance shown by some of the most important Non-Life lines of business in the region, particularly in the Health area.

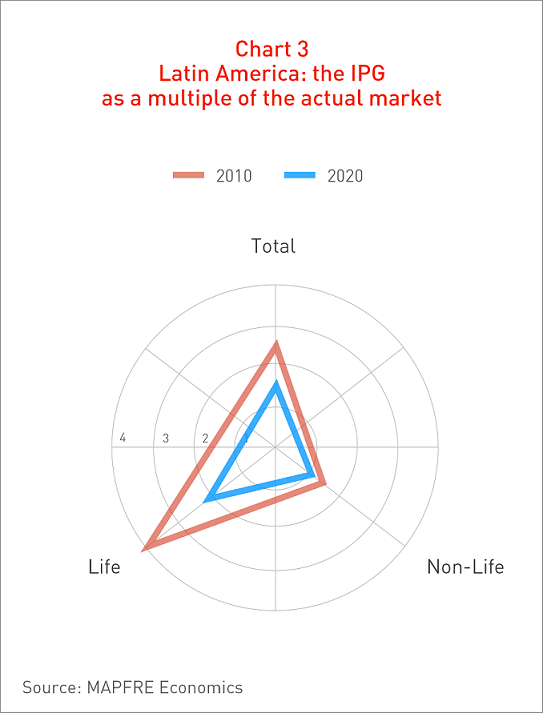

If we analyze this indicator’s performance over the past decade, there has been a 0.7 pp increase in penetration since 2010. Thus, for yet another year, the trend of increased insurance penetration in the Latin American and Caribbean region has been confirmed. This trend has been observed consistently over the past few decades, progressively closing the Insurance Protection Gap (IPG) compared to the penetration levels in developed markets, to which the Life insurance business and, to a slight extent, the Non-Life insurance business contributed (see Chart 3).

The IPG for the Latin American insurance market in 2020 is estimated at 206 billion dollars, down by 16.7% (-41.3 billion dollars) from the previous year’s estimate. The structure of the IPG over the last ten years shows no significant changes with respect to our previous report, confirming the predominance of Life insurance and, therefore, its greater growth potential. The potential insurance market in Latin America in 2020 (the sum of the actual insurance market plus the IPG) therefore stood at 340.4 billion dollars, 2.5 times larger than the current regional market.

Finally, the comparison of the different countries in the region, in terms of penetration, density and depth—indicators that measure the level of development of their respective insurance markets—is shown in Chart 4.