Industry Outlook for the Insurance Market (2Q-2021)

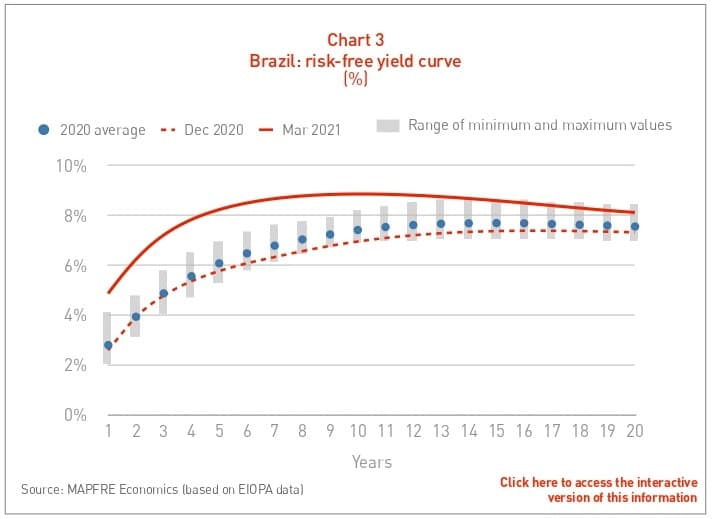

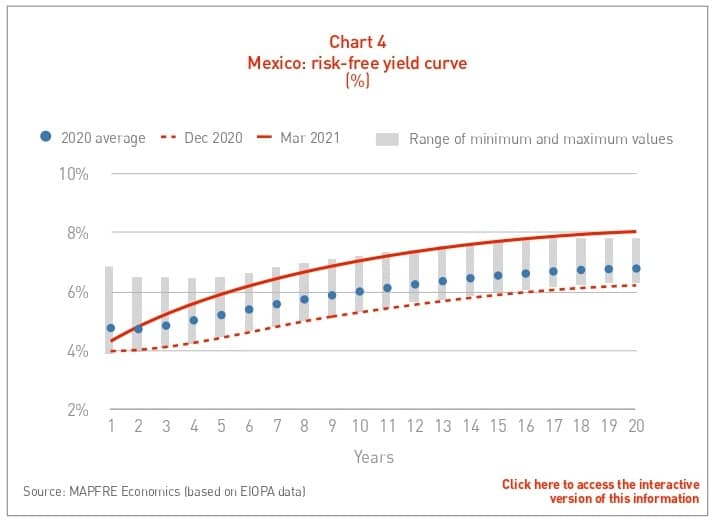

Among emerging countries, despite the pandemic, the Turkish insurance market performed better in 2020, in line with the good performance of its economy that was among the few in the world to experience slight growth in that year (1.6%) and for which economic growth prospects for 2021 are good (5.2%). Insurance markets in Mexico and Brazil, for their part, saw premiums fall in real terms, according to data at the close of the previous year. Prospects for partial recovery of their economies in 2021 may also help their insurance industries to recover. In addition, the rebound in market risk-free interest rates has improved the environment for Life savings and annuity insurance products in the latter two markets (see Charts 3 and 4).

In Spain, economic growth for 2021 is forecast to be around 6%, after an estimated fall in 2020 of 10.8%, one of the largest in the world due to the productive structure of the Spanish economy, which was hit particularly hard by the effects that restrictions on mobility had on consumption, trade, hospitality and tourism-related businesses. Recovery in 2021 will depend largely on the rate of vaccination, which has been accelerating in recent weeks, allowing for a relaxation of measures set in place as a result of further outbreaks.

The impact of the crisis on employment, trade and solvency of households and businesses continues to feed through to the insurance market unevenly across lines of business. With the latest data from ICEA (Investigación Cooperativa entre Entidades Aseguradoras y Fondos de Pensiones — the research arm of the Spanish insurance industry) for the first quarter of 2021, growth in Non-Life premiums appears to be recovering year-on-year, at around 1.9% at an aggregate level compared to premiums for the first four months of 2020 (compared to growth of 1.1% in 2020 for the whole year). The health insurance line shows growth of around 4.4% (5.1% in 2020), and multirisk continues to show great resilience both for homeowners with 4.4% (2.7% in 2020) and for condominium with 2.7% (2.8% in 2020). The Non-Life business is particularly suffering in the Automobiles line, with a fall in the first four months of 2021 of -1.2% (-2% in 2020). Other smaller lines that continue to be strongly impacted by the crisis were travel assistance insurance and, to a lesser extent, trade multirisk.

Life business premiums have grown 4.9% year-on-year in the first four months of the year (compared to the drop of 20.7% in 2020, for the whole year), with recovery of both Life savings insurance premiums with growth of 5.6% (-25.0% in 2020) and Life Protection insurance premiums with growth of 1.9% (-0.4% in 2020). In addition, it is worth noting that, despite the fall in business in 2020, savings managed through Life insurance did not decline and even showed slight growth at the end of the first quarter of 2021, reaching 194.9 billion euros (compared to 192.1 billion at the end of the same quarter of the previous year).

Full analysis of the economic and industry perspectives with additional information and interactive charts on the eurozone, Germany, Italy, Spain, the United Kingdom, the United States, Brazil, Mexico, Argentina, Turkey, Japan, China and the Philippines can be found in the report titled “2021 Economic and industry outlook: second quarter perspectives,” compiled by MAPFRE Economics and available at the following link: