Savings and insurance industry investments: an update

Author: MAPFRE Economics

Summary of conclusions from the

MAPFRE Economics report

Savings and insurance industry investments: an update

Madrid, Fundación MAPFRE, November 2024

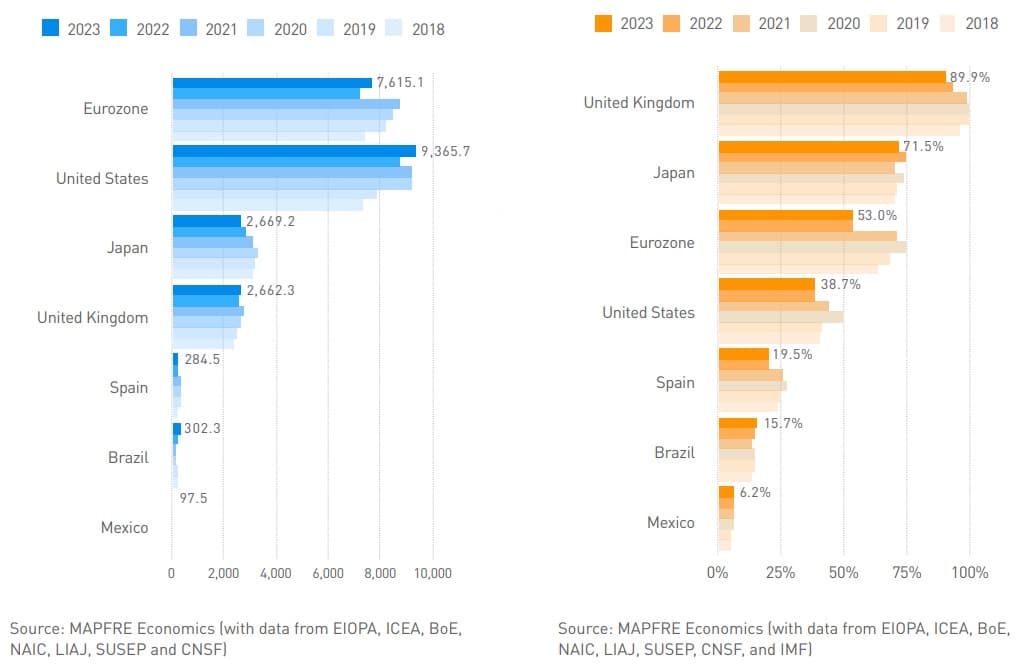

The insurance industry is one of the world’s largest savings managers and institutional investors. In 2023, the volume of savings managed by insurance companies in the main global markets once again increased in absolute value to 23 trillion euros, remaining stable when measured relatively in proportion to GDP after the anomaly seen in 2020 as a result of the COVID-19 pandemic. However, at an aggregate level, this performance was not a homogeneous, as can be seen in the insurance markets of the United Kingdom, Japan, and, to a lesser extent, the Eurozone, which saw contractions compared to the previous year.

Chart 1. Selected markets: investments managed by the insurance industry, 2018–2023

(billions of euros; % of GDP )

At a macroeconomic level, 2023 was dominated by high inflation that started to ease and an economic slowdown in response to a restrictive monetary policy and a less influential fiscal policy than in previous years, with a view to returning to normality and achieving a so-called soft landing for the economy. Such was the success of these measures that some central banks have already started cutting interest rates, with the consequent impact on the reweighting of fixed income portfolios that started to totally or partially reverse the significant inversion of interest rate curves.

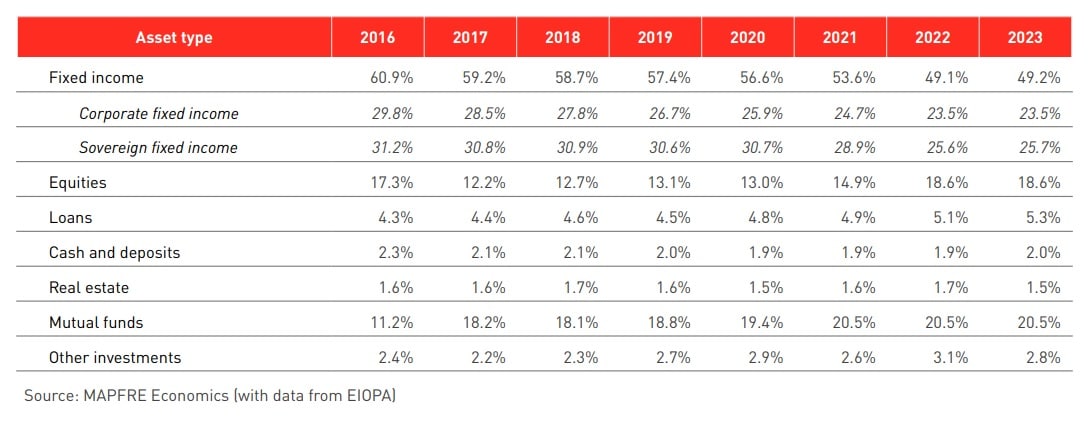

Against this backdrop, a comparative analysis of the major global insurance markets reveals the different dynamics within investment portfolios for the different economies considered during a period of high uncertainty, on account of fears of both a rebound in inflation and a potential recession. In general, adjustments in insurance company’ portfolios are usually marginal, given the need to match terms, interest rates, and currencies with their liabilities and given the consumption of capital. Therefore, as can be seen in the 2023 reweightings (see Table 1), changes in the weight of fixed income were modest during the year, with moderate changes in the composition of corporate and sovereign fixed income, while maintaining its prominent position in investment portfolios seen in previous years. Equities, in turn, did not experience relevant changes either, with a slight increase in terms of exposure in the United States and Japan, no change in the Eurozone, and slight decreases in Spain and the United Kingdom. In relation to cash and deposits, slight increases were seen, propped up by more attractive interest rates for liquidity to the detriment of investments in real estate and mutual funds, which contracted somewhat, and to a lesser extent, other investments, the outlook for which remains mixed.

Table 1. Structural breakdown of traditional business investment portfolios, 2016–2023

( %)

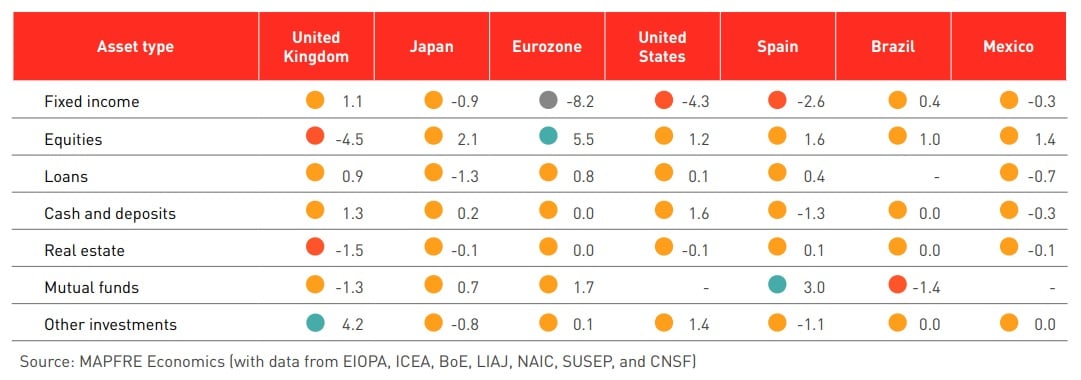

Notwithstanding the foregoing, in the medium-term analysis, it can be seen that there were some significant reweightings in both the Eurozone and United States between 2019 and 2023, with fixed income losing relative weight in the Eurozone (still majority) by 8.2 percentage points (pp) and an increase in variable fixed income of 5.5 pp during that period. The United States has also seen a drop in the weight of fixed income of 4.3 pp, with a 1.6-pp increase in cash and deposits (seeing significant increases in their profitability with the Fed’s aggressive rate hikes in 2022 and 2023) and, to a lesser extent, the 1.2-pp increase in equities (see Table 2).

Table 2. Selected markets: asset reassignment, 2019–2023

(percentage point change)

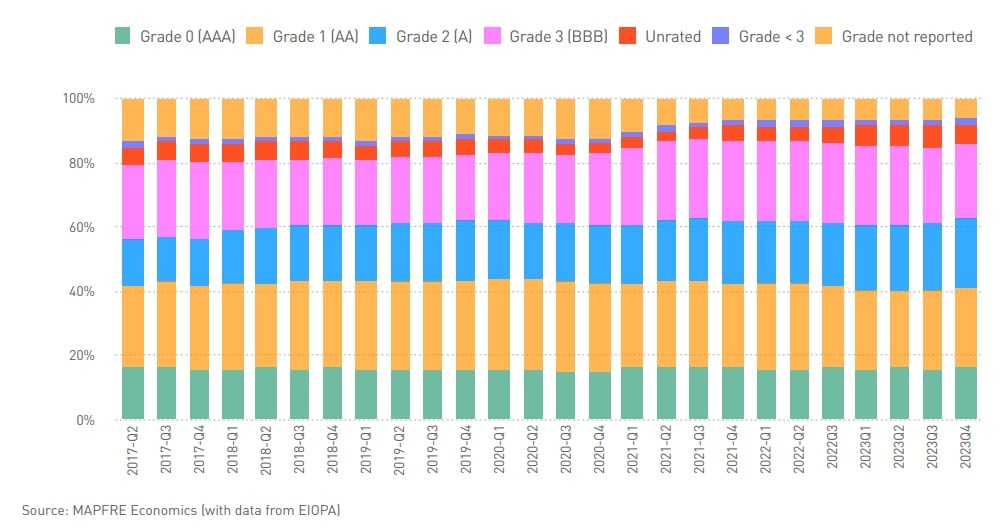

Looking ahead, as the economic expansion cycle continues and inflation settles within the target ranges defined by the central banks, it is expected that the foundations will be laid for them to obtain greater neutrality and put the cycle of monetary tightening behind us once and for all. Faced with this foreseeable context, nominal rates may return to the positive yield curve and the risk appetite may once again offer a perspective of greater normality. These factors will allow portfolio investment flows to be channeled on a more stable basis in terms of both duration and ratings, as reflected in the reweighting of the European investment portfolio by rating (see Chart 2).

Chart 2. Eurozone: credit quality of the bond portfolio

A full analysis can be found in the report Savings and insurance industry investments: an update, prepared by MAPFRE Economics and available at the following link: