Demographics: an analysis of their impact on insurance activity

On the other hand, older age groups and longer life expectancy significantly increase healthcare spending, as older individuals usually require more intensive healthcare. This healthcare spending is closely linked to the per capita income level of countries. In this way, a higher proportion of people aged 65 or older, combined with a higher GDP per capita, increases the potential for growth in healthcare spending, which encourages the development of private health insurance as a supplement to each country’s public healthcare coverage, resulting in higher healthcare benefits as contributions from those reaching retirement age decrease.

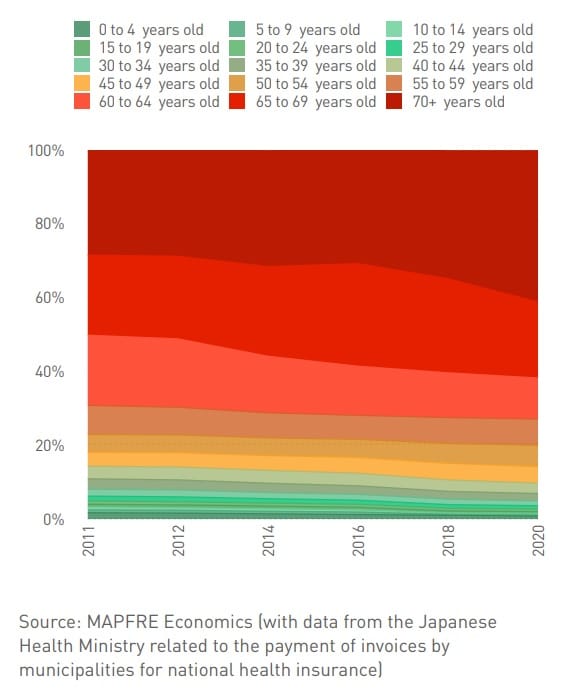

Japan, one of the countries with the oldest populations, is an example of this trend: in 2020, those aged 65 and over represented 61.6% of the public healthcare system’s spending, a figure that is expected to continue increasing in the coming decades (see Chart 3).

Chart 3: Japan: healthcare spending in municipalities by age group (%)

Other important factors for the insurance industry influenced by the demographic transition process include the housing market and the automotive sector. The long-term trend analysis in this report demonstrates how population cohorts aged 25 and older are closely linked to a country’s housing market and how their evolution is vital for the development of home insurance and loans associated with this sector. As long as the population in that age group continues to grow, the real estate market is expected to grow, and vice versa.

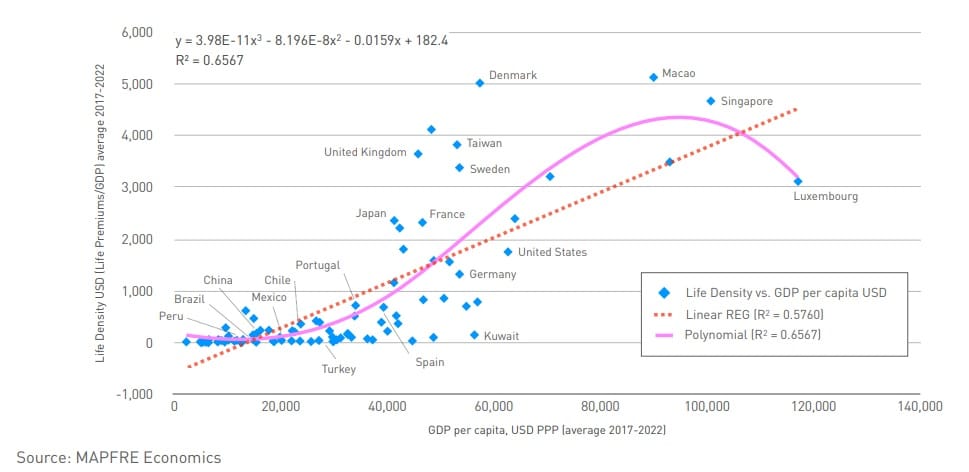

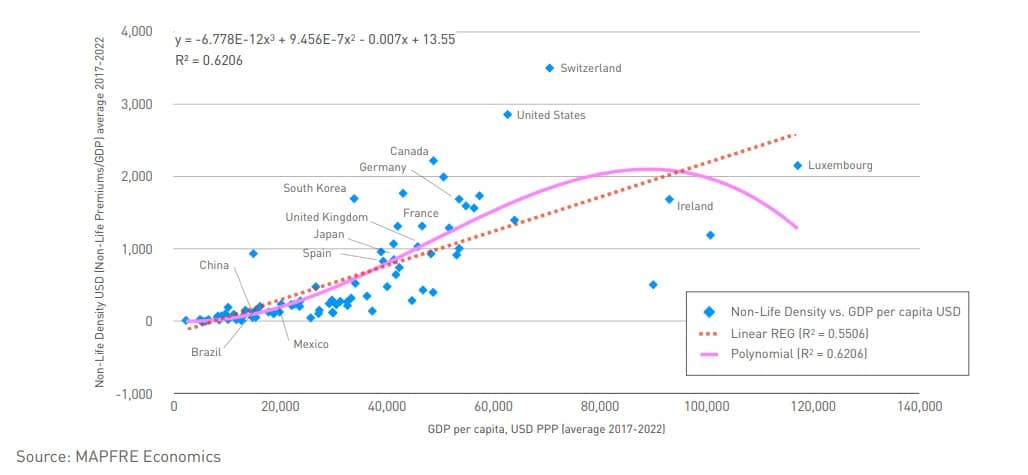

Regarding the automotive sector, a country’s GDP per capita is a key factor. This indicator is closely linked to the size of its vehicle fleet, increasing the number of vehicles per capita. This link (which also impacts the real estate market) increases the potential for automobile insurance and, overall, the density of Non-Life insurance (average annual Non-Life insurance premium per person). It is estimated that around 62.1% of the variation in this density is explained by the variability of GDP per capita across different countries (see Chart 4).

Chart 4: Fitted regression line: GDP per capita (USD PPP) vs Non-Life premiums per capita (USD)

Finally, a country’s population size is another critical factor in assessing its insurance potential, as it allows market players to achieve the appropriate size to benefit from potential economies of scale. This includes advantages such as operating with a common currency and language, expanding the reach of distribution networks, having a more consistent regulatory framework, and justifying investments in technological solutions that support operations, all backed by a sufficiently high business volume, among other factors.

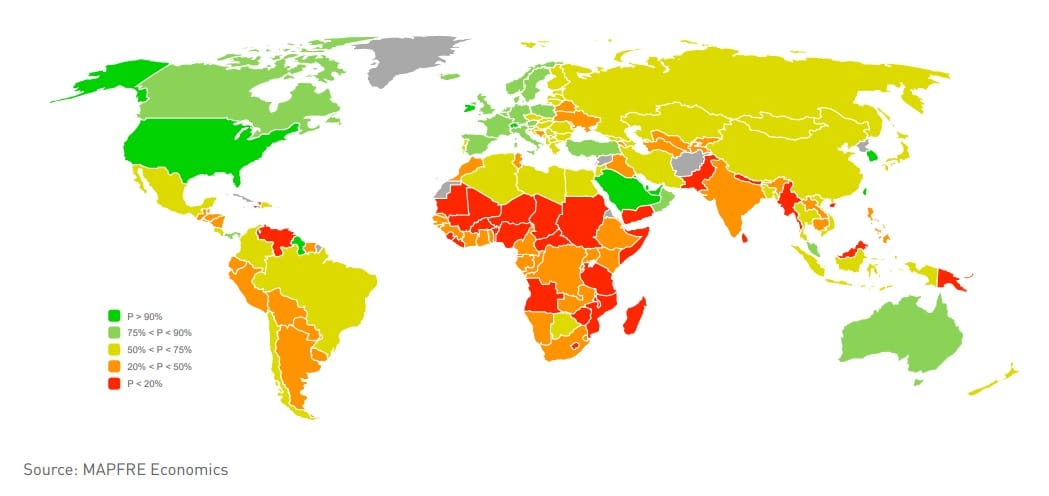

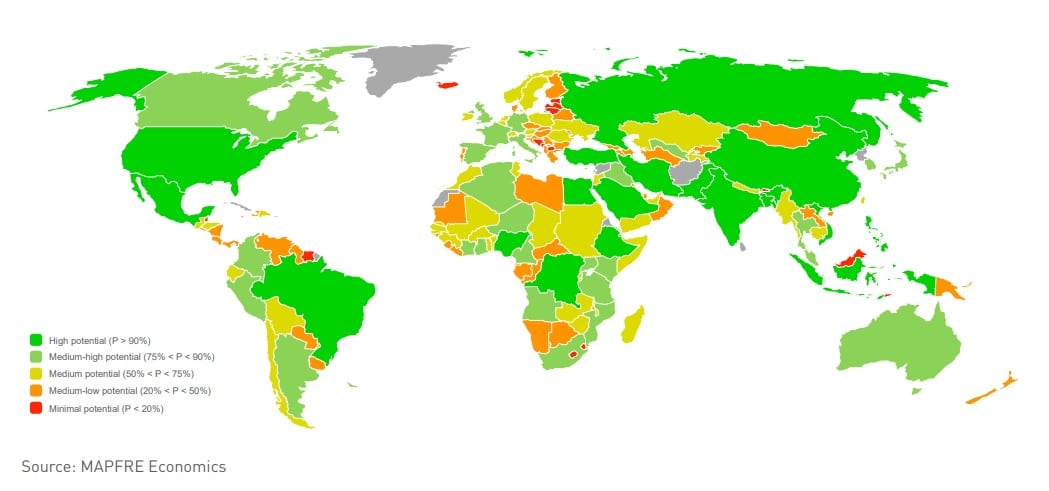

To analyze the impact of demographics on the insurance sector, MAPFRE Economics has developed the IPDFI (Insurance Potential due to Demographic Forces Indicator), which measures the insurance potential of 179 countries based on their demographic and economic traits. This indicator, covering 98.2% of the global population, summarizes the ability of insurance markets to leverage opportunities resulting from demographic transition and per capita income growth (see Table 1 and Chart 5).

Table 1. Global ranking of the insurance potential due to demographic forces indicator (IPDFI)

Countries such as China, India, and the United States lead the IPDFI, reflecting their large populations, high income levels, and growth potential within the insurance industry. In the United States, its high GDP per capita, increased healthcare spending, and growing population due to immigration strengthen its insurance potential. In the cases of India and China, their large populations compensate for their lower per capita income levels. Other countries with high potential include Brazil and Mexico in Latin America; Turkey and Russia in Europe; Indonesia, Pakistan, and Bangladesh in Asia; and Nigeria, Ethiopia, and Egypt in Africa.

Chart 5: IPDFI geography

The largest economies in Europe would be classified as having medium-high insurance potential based on demographic factors, including countries such as Germany, the United Kingdom, France, Italy, and Spain. These countries all have high relative values of potential for growth in private savings and healthcare spending, as well as in the level of GDP per capita when adjusted for purchasing power parity, which compensate for their lower potential due to slower population growth among individuals over 24 years of age and their smaller population sizes. This group also includes countries like Canada and Japan, as well as Colombia, Argentina, and Peru in Latin America.

At the following link, you can find the study Demographics: an analysis of their impact on insurance activity, prepared by MAPFRE Economics, which explores in greater detail how birth rates, mortality rates, life expectancy, and migration trends, along with their impact on the workforce, play a significant role in the growth of economic sectors related to the insurance industry.