Insurance Solvency Regulation Systems Outlook

Author: MAPFRE Economics

Summary of report’s conclusions:

MAPFRE Economics

Insurance Solvency Regulation Systems Outlook

Madrid, Fundación MAPFRE, March 2024

Insurance is an activity subject to prudential regulation and supervision as well as resolution mechanisms mandated at the international level. In this regard, it is just like the activities conducted by other financial institutions, as it not only receives and manages third-party financial resources, but also plays a key role in aspects that could generate disruptions in the economic system.

Over the last few decades, prudential regulation in the financial system (and that applicable to the insurance industry) has been subject to a continual adjustment process towards risk-based systems that seek to align public-interest objectives with the creation of incentives to obtain comparative advantages (in a pro-competitive environment), based on the quality of financial institutions’ risk management.

In the insurance sector, the global initiative for convergence with the rest of the financial system has had three key dimensions. The first consisted of the International Association of Insurance Supervisors (IAIS) drafting regulation and supervision principles and standards, which have gradually been implemented by member countries of that standard-setter organization. The IAIS’s plan to establish an Insurance Capital Standard (ICS), which is expected to be implemented in 2025 (under the name of Prescribed Capital Requirement, PCR), falls within this context. The second dimension, at the regional and principal markets level, was the determination to modernize existing solvency regulation systems. This framework gave rise to the European Solvency II plan, the Solvency Modernization Initiative (SMI) by the NAIC (National Association of Insurance Commissioners) in the United States, and the development of the Swiss Solvency Test, among others. And the third of these dimensions, following the financial crisis unleashed in 2008 with the collapse of Lehman Brothers in the United States and subsequent sovereign debt crisis in the European Union, was the determination to implement macro-prudential surveillance measures in order to limit potential systemic effects derived from insurance activity.

Currently, most insurance markets are immersed in ongoing regulatory adjustment processes that are still guided by the three dimensions mentioned above: the process of regulatory standardization and supervisory practices; the modernization of solvency systems toward risk-based models; and progress toward the establishment of a global solvency system (similar to that used in the banking sector) that will contribute to maintaining global financial stability.

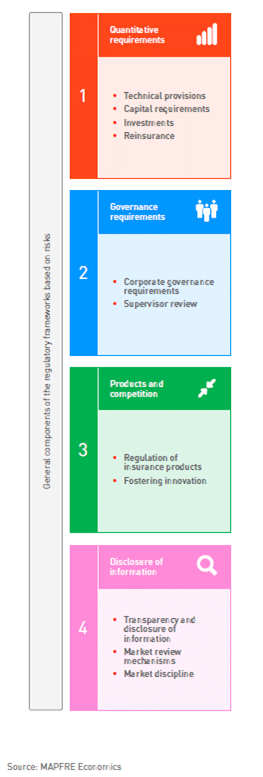

However, the various markets are moving toward solvency frameworks at the global level that attempt to cover, in general terms, four fundamental elements. First, a set of quantitative requirements in terms of capital, technical provisions, investments, and reinsurance that guarantee insurance companies’ financial position. Second, a series of corporate governance standards that promote more professional (risk-based) management of companies, with the belief that this is a contributing factor in limiting the probability that a company will become insolvent. Third, prudential regulatory standards that could impact competition and innovation, and therefore the market’s efficiency, such as those regulating products that could be brought to market and their conditions (structure and price). And finally, a series of transparency and information disclosure standards, which seek to improve how the market discipline mechanism works, as an additional element to stimulate companies’ management to reduce the likelihood of insolvency (see Chart 1).

Chart 1. General components of the regulatory frameworks based on insurance risks

Analysis by region

Currently, in the United States, most states have decided to incorporate the Risk-Based Capital (RBC) model into their respective legislation without substantial changes. The qualitative requirements are based on the NAIC’s “Risk Management and Own Risk and Solvency Assessment Model Act.” It should be noted that the regulatory model designed by the NAIC emphasizes the assessment of assets and liabilities, together with qualitative and quantitative regulations, and includes limits applicable to investments, as well as prerequisites for the launch of new products. All the states, without exception, apply regulatory limits to investments and prerequisites for the launch of new products, following the NAIC model or with their own adaptations.

In Latin America, generally speaking, progress continues in terms of the incorporation of qualitative requirements into insurance companies’ risk management (Pillar 2 of the Solvency II-type models), although Solvency I-type regulation systems persist in terms of quantitative requirements (Pillar 1).

In them, the determining factor of the capital requirement is defined by the underwriting risk, with a system based on one or more factors applied to magnitudes considered representative of the level of exposure to insurance risk, such as premiums, loss ratios (in Non-Life insurance), or mathematical provisions and/or capital at risk (in Life insurance). Additional rules on governance and investments have been introduced in order to control financial risks, diversify and spread assets, and establish specific regulatory limits.

In the Asia-Pacific region, with the exception of the Philippines, which introduced mandatory implementation of an ORSA in 2022 for large companies, there has not been significant regulatory progress with respect to the last assessment completed with information from 2017. Australia and Japan, two mature and developed insurance markets, continue to show the greatest degree of regulatory development. Japan has made significant progress in relation to how insurance companies and financial institutions treat risks, with the goal of introducing a solvency system based on Solvency II-type economic value in 2025.

In the European Union, eight years after its implementation, on December 14, 2023, the European Parliament and the Council reached an agreement on the European Commission’s proposal to amend the Solvency II regulatory framework. The purpose of this proposal is to adjust the aspects deemed necessary, and in particular, to give the insurance industry better incentives to make long-term investments, in line with the Capital Markets Union initiative, making the financial strength of insurance companies less sensitive to short-term market fluctuations and improving the calculation of certain risks, including those related to climate change. Finally, it should be noted that following the United Kingdom’s exit from the European Union, the country is in the process of reviewing the Solvency II system applicable to the UK. The Prudential Regulation Authority (PRA) is currently conducting the corresponding Quantitative Impact Studies (QIS) in order to gather the information necessary to determine which reforms would be the most appropriate to meet the goals set by the country’s government. However, for now the applicable system is similar to Solvency II.

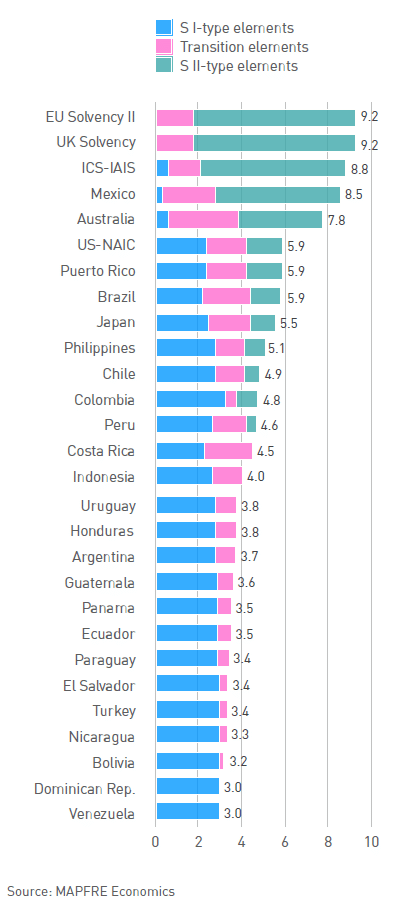

Based on the analysis of prudential regulations applicable to insurance companies and their groups in a set of countries in several regions of the world (United States, Latin America, Asia-Pacific, United Kingdom, and European Union), as well as their modifications since MAPFRE Economics’ last assessment in 2017 , the progress towards risk-based regulation achieved since then has been incorporated. Following the methodology used in the previous study, the analysis considers a total of twenty-three relevant factors that characterize the different solvency regulation systems, which are presented, to a greater or lesser extent, based on how much these systems have evolved towards pure risk-based systems. These factors allow us to calculate a synthetic indicator known as the Risk-Based Regulation Proximity Index (I-RBR).

The I-RBR seeks to identify the degree of progress of the various regulatory frameworks in terms of their transition from basic risk-based regulation (Solvency I-type) to regulation focused on more precise risk management and measurement, strengthening corporate governance, and greater transparency and disclosure of information to the market (Solvency II-type).

In general terms, the simplest systems (like Solvency I) are characterized by having the underwriting risk as the determining factor of the solvency capital requirement, with a system based on one or more factors applied to magnitudes considered representative of the level of exposure to insurance risk, such as premiums, loss ratios in Non-Life insurance, or mathematical provisions in Life insurance. This requirement is accompanied by a series of additional governance and investment standards to limit market and credit risks by introducing specific regulatory limits on diversification and dispersion, as well as a closed-list classification of assets eligible to cover the obligations arising from insurance contracts. Meanwhile, systems further developed towards a purely risk-based prudential regulatory system (such as Solvency II) are characterized by a greater number of risk factors considered, and they introduce more complex scenario simulation techniques for calculating the specific capital risk weights for underwriting, market, and credit risk, consideration of risk interdependence, and the use of internal models or calculation of regulatory solvency capital requirements at the group level, among others. These systems usually include explicit risk assessment measures, with a predefined time horizon and confidence level, such as value at risk (VaR or tail VaR), which would apply both in the calculation of capital under standard formulas, when the applicable factors or scenarios are calibrated under this explicit measure, or by applying internal models.

Under the analysis criterion of the regulatory measures formally implemented as a basis to estimate the I-RBR, the countries in Latin America can be classified into three groups (see Chart 2). The first group consists of two insurance markets (Dominican Republic and Venezuela) with regulatory systems that essentially maintain the features of the Solvency I-type systems, and implemented measures that suggest a transition toward risk-based systems have not yet been identified. Since the previous assessment (with information as of 2017), Argentina, which was part of this first group, has moved into the second group due to its progress in the regulation of the second pillar. This group is now made up of ten markets (Argentina, Costa Rica, Uruguay, Ecuador, Guatemala, Paraguay, El Salvador, Panama, Nicaragua, Bolivia, and Honduras). While these markets maintain Solvency I-type regulations, they have gradually progressed, with varying depth levels, in the implementation of transitional measures towards risk-based regulation. Finally, a third group of countries consists of six markets (Mexico, Brazil, Puerto Rico, Colombia, Chile, and Peru) that, in addition to varying degrees of progress in transitional measures towards risk-based regulation, have already implemented (also with varying degrees of depth) measures that are fully consistent with risk-based regulation (Solvency II-type). In particular, in 2015, Mexico and Brazil obtained provisional equivalence to the Solvency II system from the European Commission for a ten-year period; this equivalence must be renewed, if applicable, in 2025.

Chart 2. Analyzed models: Risk-based Regulation Proximity Index (I-RBR)

Our detailed analysis of regulatory models in each region highlights the complexity and diversity of the approaches taken. These regions show progress towards more risk-based regulation, but there are significant differences in how they have implemented and adopted the proposed regulations, guided by the three dimensions discussed above (standardization and supervision, modernization, and global financial stability). The regulatory changes have resulted in tangible benefits for insured parties, guaranteeing better protection and more stability in the insurance industry.

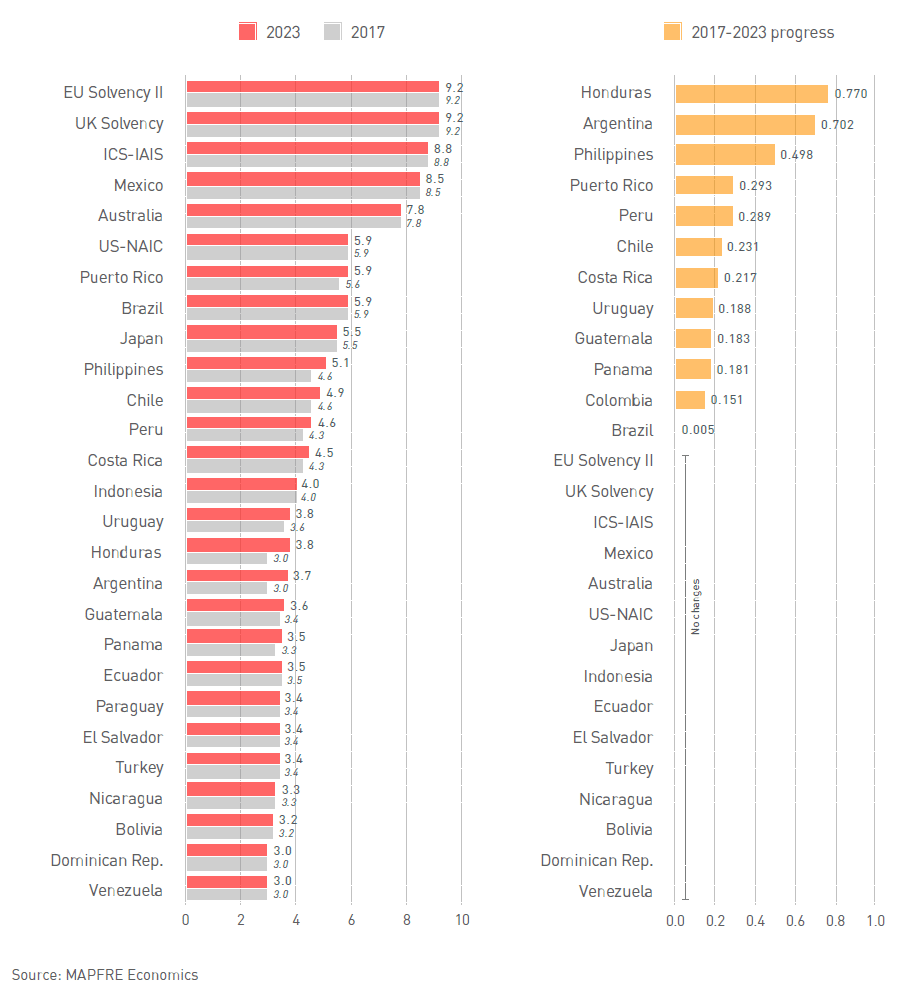

Chart 3 provides a comparative view of insurance solvency regulation systems in several regions of the world, highlighting the progress towards risk-based regulation despite the persistence of elements of more traditional regulatory models. It shows the updated value and composition as of January 2024 (based on data from 2023) of the Risk-Based Regulation Proximity Index (I-RBR), estimated from the analysis performed on each regulatory model considered in this study and its development since the last assessment in our 2018 report.

Chart 3. Analyzed models: change in Risk-Based Regulation Proximity Index

(I-RBR), 2017-2023

Finally, while it is true that risk-based regulatory models can improve insurance market performance, they are more complex models that require, as preconditions, the existence and development of new institutional and market infrastructure. Therefore, they involve lengthy design, implementation, and internalization processes. The existence of institutional and market preconditions that allow the risk management function to be carried out effectively and efficiently determines the speed and likelihood of further progress of this type of regulatory model in the different markets. Moving forward to implement this type of regulatory system before these preconditions are met may limit the benefits of its implementation and, under certain conditions, even create undesired effects that hinder the operation of the insurance market. In conclusion, continuous adaptation and stronger regulatory frameworks are necessary to respond to the changing dynamics of the global financial system. The need to learn from past crises and anticipate future vulnerabilities is also crucial to ensure a stabler, more resilient financial system, capable of withstanding the challenges of a globalized and highly interconnected economic landscape.

The full analysis can be found in the report entitled Insurance Solvency Regulation Systems Outlook, prepared by MAPFRE Economics and available at the following link:

[1] See: MAPFRE Economic Research (2018), Insurance Solvency Regulation Systems, Madrid, Fundación MAPFRE

[2] See: MAPFRE Economic Research (2024), Insurance Solvency Regulation Systems Outlook, Madrid, Fundación MAPFRE. Table 2.1 page 28.