The Spanish insurance market in 2022

Author: MAPFRE Economics

Summary of report’s conclusions:

MAPFRE Economics

The Spanish insurance market in 2022

Madrid, Fundación MAPFRE, July 2023

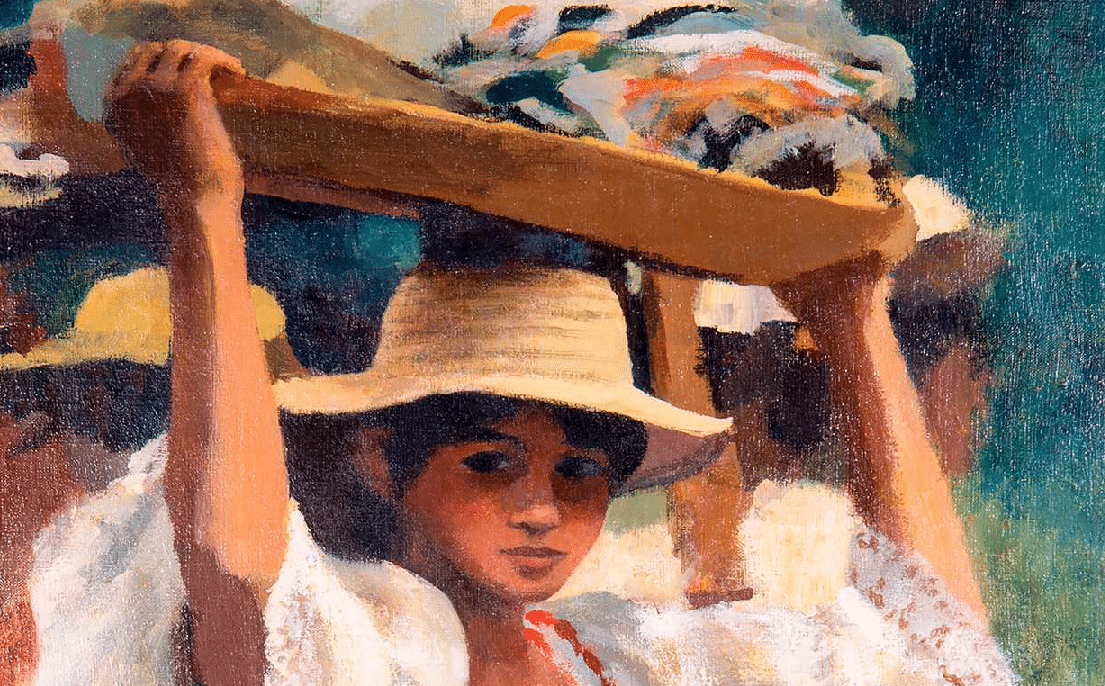

So far in 2023, the Spanish insurance industry is seeing positive growth above inflation in all the major business segments, particularly in the Life savings insurance business, which had premium growth of 57.8% up to the end of September. This is with the help of interest rate rises and the delay in remunerating deposits by banks, which continues to open up business opportunities in attracting savings, but which may decline as banks adapt their deposit remuneration policies to the new interest rate environment (see Chart 1).

Chart 1. Trends in direct Life insurance

(annual variation, %)

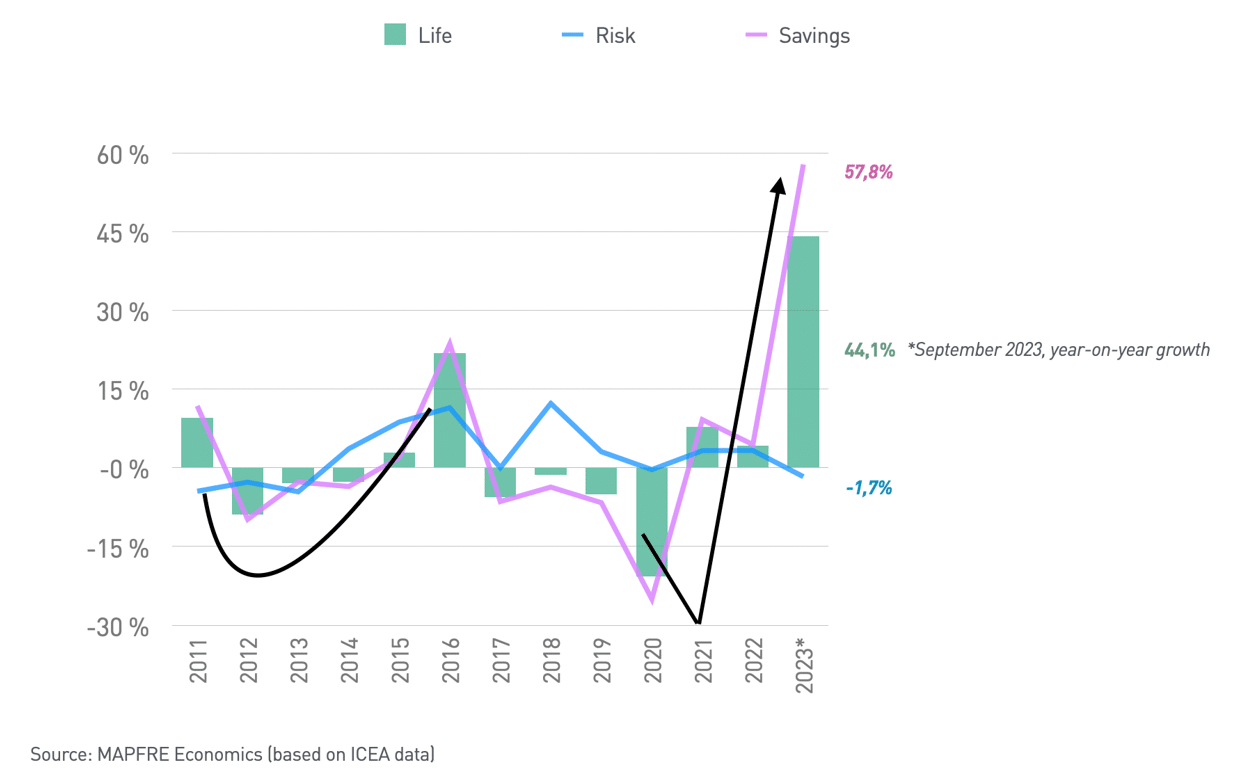

Economic growth, which is higher than initially expected, is also supporting this good performance of the insurance business, particularly in the Non-Life business (see Chart 2), although the prospects of a slowdown in the coming year could affect the more cyclical businesses linked to credit performance, such as Motors and Life protection.

Chart 2. Trends in Non-Life insurance

(annual variation, %)

The environment for insurance activity in 2022 was challenging in many respects. The global economy again performed better than initially forecast, with aggregate growth of 3.4%, a slowdown from 6.3% in 2021, a year of atypical growth after the pandemic-induced decrease. However, it was a year marked by a sharp upturn in inflation following the extensive monetary and fiscal support packages implemented in the previous two years, and which was fueled by supply bottlenecks following the process of economic reopening and by the invasion of Ukraine. For its part, the performance of the Spanish insurance market was marked by the economic recovery. At the end of the year, it was still below pre-pandemic GDP levels, with an increase in the volume of total insurance premiums of 4.8% (4.9% in 2021), to 64,775 million euros, against a backdrop of high inflation, which rose to levels not seen in decades (8.4% in 2022).

Despite the uncertainty experienced in 2022, Life insurance in Spain showed its strength, with written premiums of 24,535 million euros, 4.2% more than the previous year. Both life protection and life savings performed well during the year, with growth rates of 3.4% and 4.4%, respectively. Non-Life lines, for their part, earned a premium volume of 40,239 million euros, which represents an increase of 5.2% compared to 2021 and is two percentage points higher than in the previous year.

Automobile insurance recovered the growth path in 2022, reaching a premium volume of 11,353 million euros, 3.3% more than in 2021 and above the premiums written in 2019, before the start of the pandemic. This increase in business was influenced by the rise in the average premium, which stood at 345.2 euros, 2.3% more than in 2021, as well as the increase in insured vehicles which, with 32.9 million vehicles, was up 0.9%. In addition, the combined ratio of the business line increased again in 2022, to 98.0%, (94.1% in 2021), due, in addition to the increase in the frequency and severity of claims, to the rise in inflation and the higher costs of suppliers, such as repair shops, spare parts, etc. In the first six months of 2023 the combined ratio continued to worsen and stood at 100.7%, an increase of 4.3 pp compared to the June 2022 ratio. Nevertheless, an improvement in both technical and financial profitability is expected, as upward revisions to insurance premiums materialize to adapt them to inflation, cost growth eases and financial income from investment portfolios begins to increase due to interest rate increases.

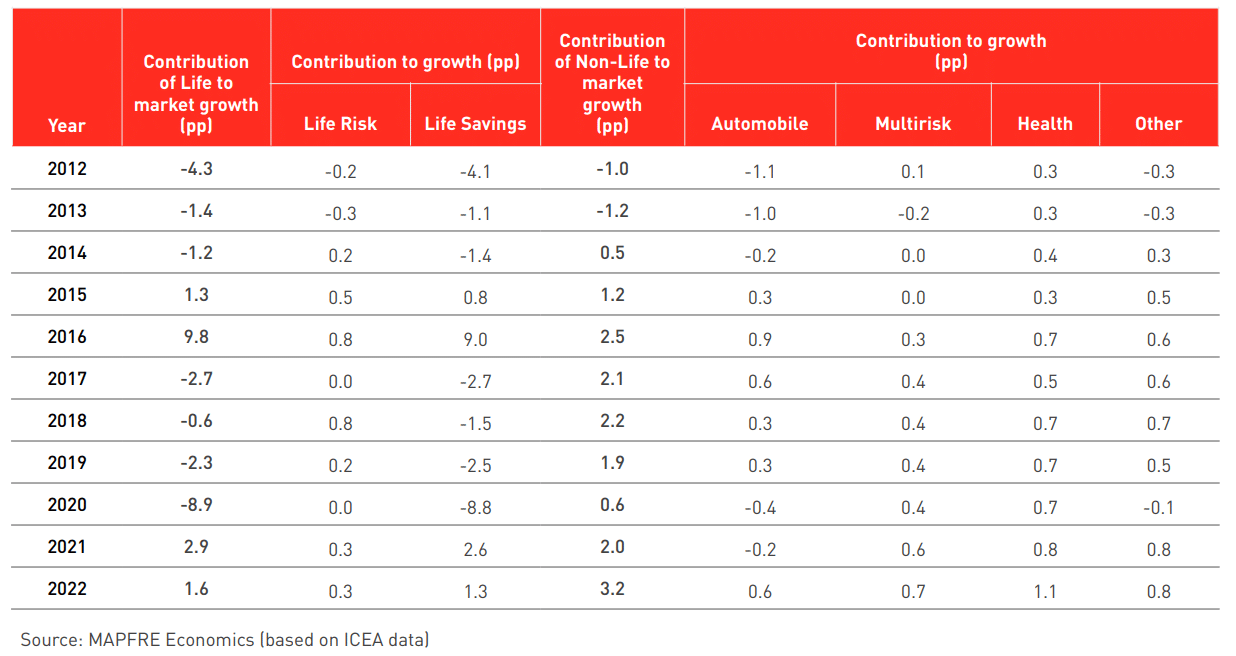

Table 1. Contribution to Life and Non-Life insurance market growth

(percentage points, pp)

Health insurance again showed great momentum in 2022, with a 7.0% rise in the volume of written premiums, to 10,543 million euros, as it was the line that contributed most to the growth of the Non-Life segment, with 1.1 pp (see Table 1). This growth in premiums has been accompanied by an increase in the number of policyholders, which reached 13.8 million, which is 3.7% more than in 2021. In 2022, the upward trend in the claims ratio already noted in the previous year was confirmed, influenced by: (i) the consolidation of the increase in inflation, which has had a direct impact on the increase in hospital costs; (ii) the continued high frequency of use of health care services by insured parties; and (iii) the increases in the health care fee scales agreed with the insurance companies by the large private hospital chains. In the first nine months of 2023 the industry’s revenues continued the upward trend of recent years, with a 6.9% increase in premiums owing to the momentum of Expense Reimbursement, which grew by 9.4%, and Health Care, which grew by 7.0%.

Multirisk Insurance also performed well in 2022, with 5.7% premium growth, which is one percentage point higher than in the previous year. Industrial Multirisk insurance has sustained an uninterrupted growth trend over the last five years and increased by 8.8% in 2022. Home and Condominiums also had growth above the previous year, exceeding 2021 premiums by 5.5% and 4.9%, respectively. Commerce, however, grew below the rates seen in previous years, to 1.2%. Fortunately, 2022 was not a year of intense atmospheric phenomena. Hence, despite the existing inflationary process, it was possible to close the year with a reduction of -0.7 pp in the combined ratio, which ended at 96.4%.

Lastly, the Life business in 2022 reached a total premium volume of 24,535 million euros, with a 4.2% increase over the previous year and -10.9% below the aggregate figure of 2019. In addition, with respect to managed savings, technical provisions in the life insurance business decreased by -1.1% to 193,613 million euros. Life protection and Long-Term Care insurance grew and all savings/retirement products, with the exception of unit-linked insurance, showed decreases in assets, with an aggregate rate of -1.2%.

The rise in interest rates that began in 2022 is being reflected in guaranteed Savings insurance, which is gaining an appeal that it previously lacked. The statistics for the first nine months of 2023 confirm this change of trend in Life Savings insurance, which has become the driving force behind the growth of Spanish insurance during the year, increasing by 57.8%, with the rate of increase of this line of business standing at 44.1%. Savings managed by Life insurance also grew, reaching a volume of 200,723 million euros, with year-on-year growth of 4.9%.

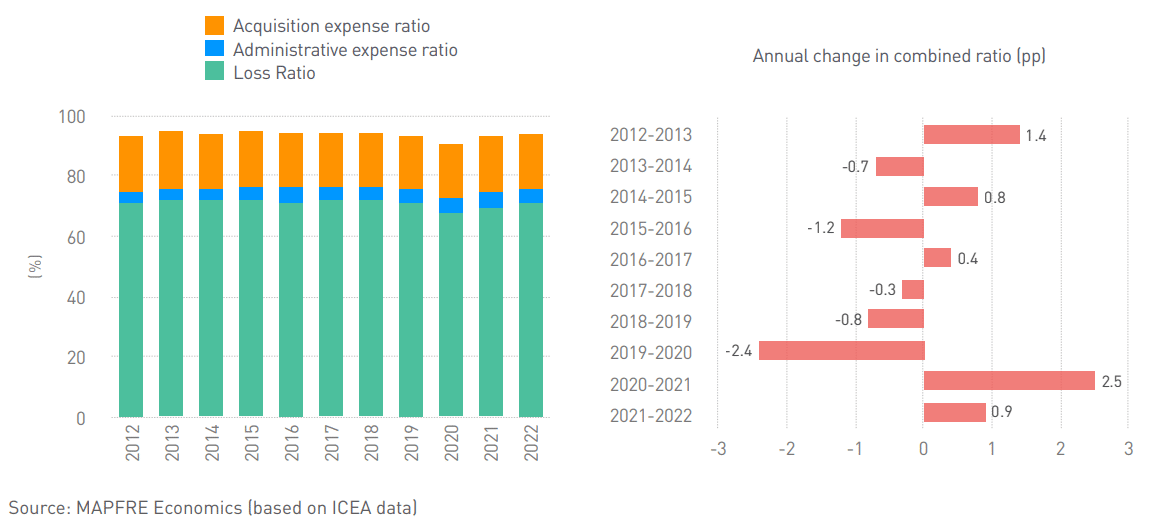

As regards technical profitability, the combined ratio for the Non-Life insurance segment in 2022 was 93.8%, which is 0.9 pp more than the level of 2021 (92.9%), due to a worsening of the claims ratio by 1.3 pp, which was 70.6% (69.2% in 2021). Conversely, the administration and acquisition expense ratios showed a slight improvement over the previous year, at 5.2% (-0.1 pp) and 18% (-0.3 pp), respectively (see Chart 3).

Chart 3. Trends in the Non-Life combined ratio

(total combined ratio, %; annual change in combined ratio, pp)

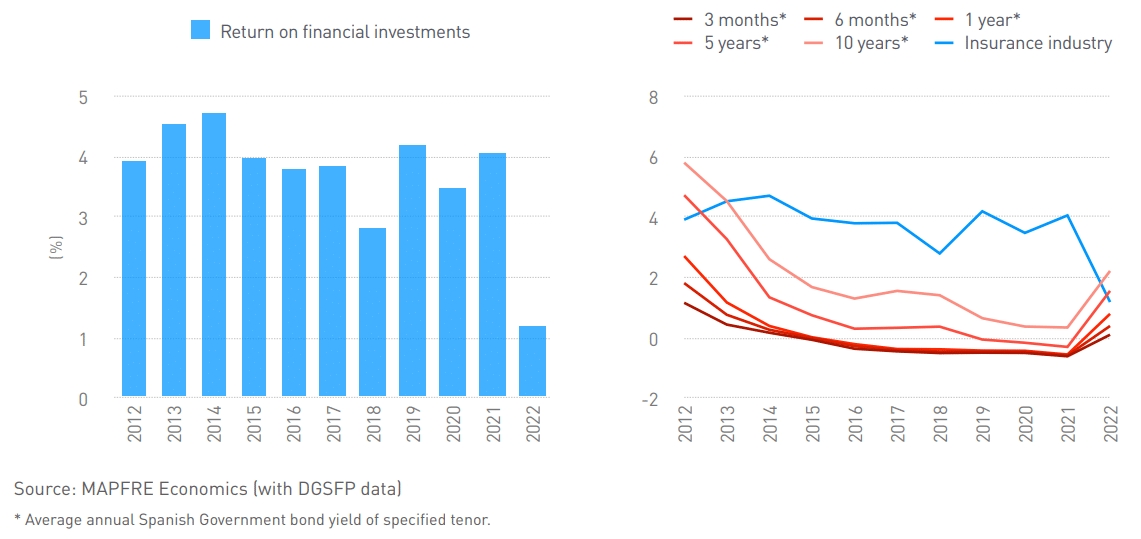

The profitability of financial investments in the insurance industry was 1.2% in 2022 (2.9 pp below that of the previous year), as it was hurt by the normalization of the European Central Bank’s monetary policy (see Chart 4). However, the most recent dynamics show some stability in 2023, as interest rates approach a terminal rate and volatility is easing in tandem with more stable expectations. The total volume of investment by Spanish insurance companies decreased to 280,619 million euros in 2022, representing a -15.0% decrease compared to the previous year.

Chart 4. Return on the insurance industry’s financial investments

(financial income / average investment, %; risk-free interest rate, %)

In terms of aggregate profitability indicators, the earnings of the Spanish insurance industry came to 5,526 million euros in 2022, an increase of 9.0%, thus partially recovering from the fall suffered in the previous year (of -12.5%) owing to the good profitability performance of the Life insurance segment. The industry’s profitability also improved in relative terms, with a return on equity (ROE) of 12.5%, 2.1 pp above the previous year, and a return on average total assets (ROA) of 1.7%, an improvement of 0.3 pp.

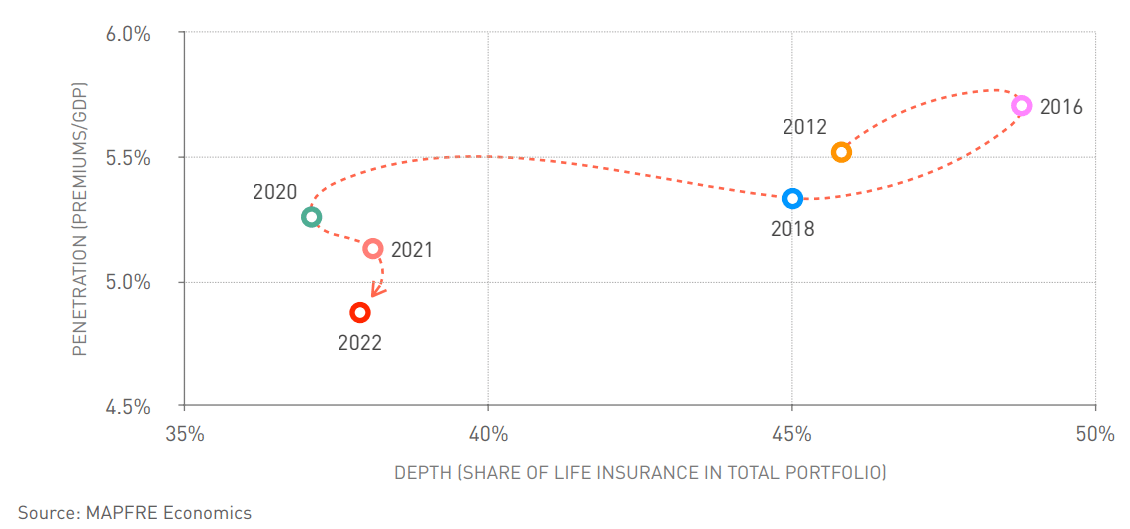

In terms of structural market trends in 2022, the penetration of Spanish insurance (ratio of premiums to GDP) was 4.9% at the end of 2022 (5.12% in 2021). As was the case in 2021, a strong rise in GDP at current prices (10.1%) in 2022, together with more moderate growth in premium revenue in the insurance sector (4.8%), contributed to another small setback by the sector in this indicator. Conversely, the density of insurance in Spain (premiums per capita) stood at 1,347.8 euros in 2022, an increase of 46.6 euros compared to 2021. Lastly, the growth recorded by the Life line in 2022 proved insufficient to boost the depth level of insurance compared to the previous year, which stood at 37.9%, down from 38.1% the previous year and a far cry from the 48.8% achieved in 2016 (see Chart 5).

Chart 5. Trends in the Spanish insurance market

(penetration vs. depth)

A detailed analysis of the different business lines and structural trends in the last decade can be found in the report The Spanish Insurance Market 2022, prepared by MAPFRE Economics and available at the following link: