The Latin American insurance market in 2022

Author: MAPFRE Economics

Summary of report’s conclusions:

MAPFRE Economics

The Latin American insurance market in 2022

Madrid, Fundación MAPFRE, September 2023

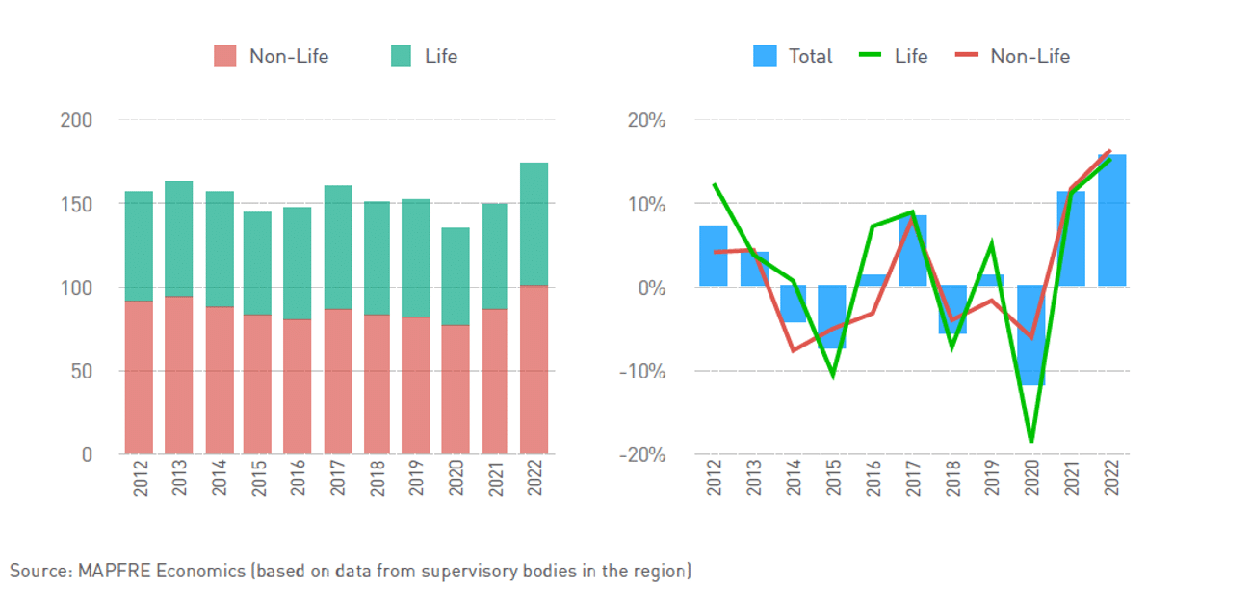

The latest available data continue to show a trend towards economic slowdown in the Latin American and Caribbean region in 2023. This has occurred under the influence of the restrictive monetary policy applied virtually across the board by their respective central banks, a policy some of them have begun to reverse, as in the case of Brazil, Chile and Peru. The economic slowdown is affecting the volume of insurance business, which is beginning to grow at a slower rate than in the previous year in some of the main markets. It is noteworthy that the Latin American insurance sector was one of the best performers worldwide in 2022, with significant growth in written premiums both in the Non-Life and Life insurance segments. It has been helped by better-than-expected economic growth and the quick response of Latin American central banks to the upturn in inflation, with interest rate hikes anticipating those in developed markets (see Chart 1).

Chart 1. Latin America: Growth Developments in the Insurance Market

(premiums, billions of USD; annual nominal growth rates in USD, %)

These interest rate hikes allowed higher returns to be offered on life savings products and annuities, acting as a hedge against the loss of purchasing power and offering positive real returns in some markets. In addition, higher interest rates helped to improve the profitability of the insurance industry and led to generally favorable trends in exchange rates, which then influenced the volume of insurance business, which benefited from the greater stability of their respective currencies. Some of the large markets (particularly Brazil) also benefited from an appreciation of the exchange rate against the dollar, which in turn had a positive effect on the profitability by helping to curb inflation.

The Latin American insurance market in 2022 reached an aggregate premium volume of 173.7 billion dollars, representing growth of 15.9% (11.5% in 2021), above the previous year’s growth and exceeding the pre-pandemic level. This good performance of the insurance industry in Latin America meant that the region’s insurance market share in the world total remained on track to recovery, amounting to 2.6% of global premiums in 2022. However, this is still a small percentage considering the size of the region’s economy, which currently represents around 6% of global GDP and 8.3% of the world’s population.

Premiums in the Life insurance segment in Latin America and the Caribbean again showed significant growth, higher than in the previous year, at 15.3% measured in dollars (11.2% in 2021), as did Non-Life insurance premiums, which grew by 16.4% (compared to 11.7% in 2021). The main driver of growth in Non-Life insurance was the Motors line, which had suffered at the worst moments of the pandemic. Health insurance, for its part, grew significantly, but less than in the previous year. In the Life business, the Colombian market made a significant contribution to the growth of the Life insurance segment at the regional level, which combined with the healthy performance of the Brazilian market (the main market in the region) and other markets with significant weight such as Argentina and Chile.

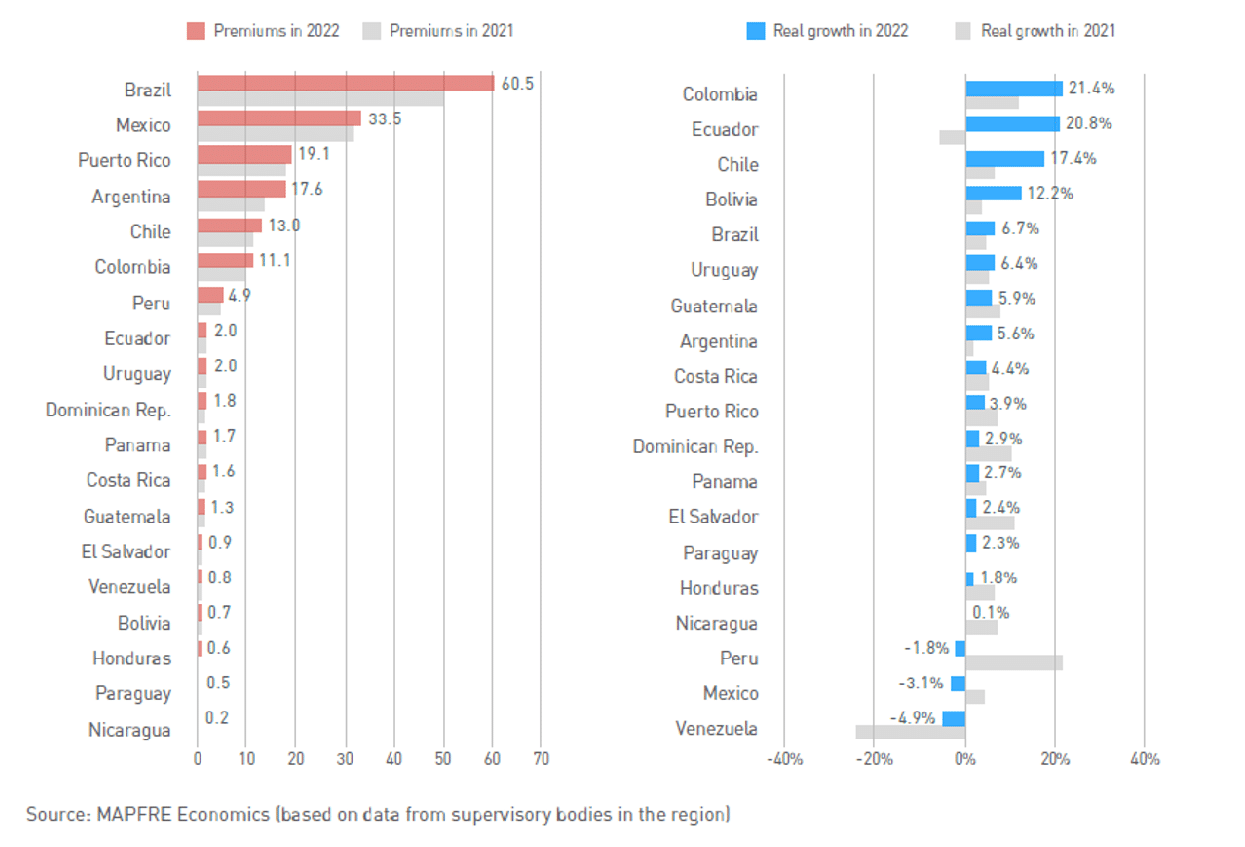

An individualized analysis of insurance activity in local currency for each of the markets shows that the strong upturn in inflation in 2022 caused some markets, which had shown positive real growth the previous year, to see decreases in their business volume when correcting their nominal growth in local currency for the effect of inflation, thus revealing slowdowns in their real growth. This was the case of Mexico and Peru, although both markets showed a good performance in terms of profitability (see Chart 2). Otherwise, with the exception of Venezuela, which continued the downturn it had seen the previous year, the year saw growth in real terms virtually across the board in the region, with the largest increases seen in the insurance markets of Colombia (21.4%), Ecuador (20.8%), Chile (17.4%), Bolivia (12.2%) and Brazil (6.7%).

Chart 2. Latin America: Insurance Market Premiums and Real Growth

(billions of USD; real growth in local currency, %)

In profitability, the aggregate net result of the Latin American insurance market in 2022 came to 9,909.4 million dollars, representing growth of 49.8% compared to the aggregate result of the previous year. However, despite this growth, the regional aggregate result was still below the levels reached in the years prior to the outbreak of the pandemic. In general, profitability indicators recovered from the significant decline suffered in the previous year due to the generalized increase in claims in lines of business such as Automobiles or Health after the economic reopening process, together with excess mortality as a result of the pandemic, which was substantially higher in the Latin American region, which affected the profitability of Life insurance risk. Most of the region’s markets reported positive aggregate net results, with significant growth in the results of the two largest markets, Brazil and Mexico, as well as other markets with a significant weight in business volume, such as Colombia and Peru.

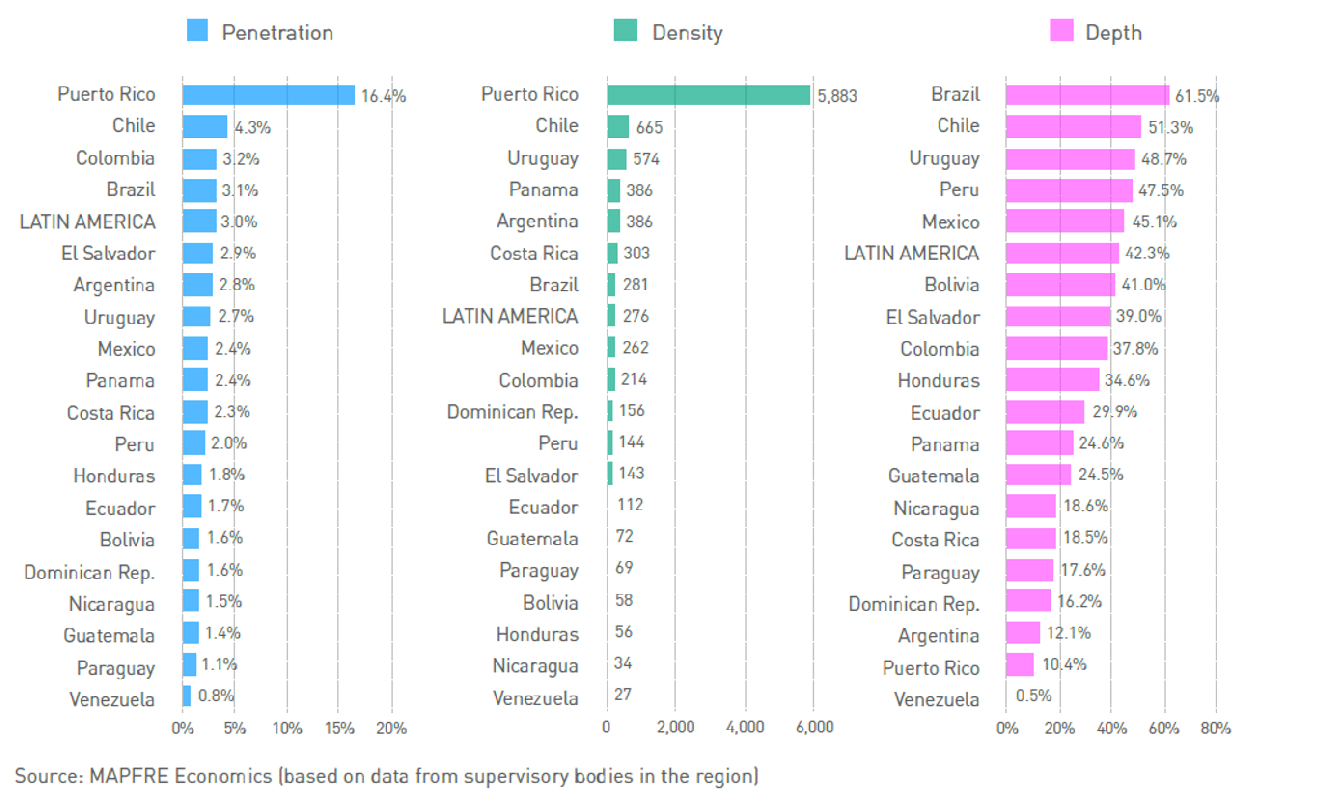

In structural trends, the average penetration rate (premiums/GDP) of the region stood at 3.01% in 2022, 0.05 percentage points (pp) higher than the previous year’s rate. This indicator improved in the Non-Life Insurance segment (1.74% versus 1.70% the previous year) and, to a lesser degree, in the Life Insurance segment (1.27% versus 1.26% the previous year). From a medium-term perspective (2012-2022), it can be seen that there was an increase in penetration in the region of 0.4 pp (in terms of GDP). Apart from the one-off event caused by the sharp contraction in GDP due to the pandemic, which led to an atypical increase in penetration, an upward trend in insurance penetration in the region continued throughout the decade, to which the growth of Life insurance and, to a lesser extent, Non-Life insurance mainly contributed. Nevertheless, the good performance of Health insurance as a result of the pandemic was also a factor in the shortening of the gap with Life insurance over the decade as a whole. Puerto Rico continues to report the highest penetration index in the region, amounting to 16.4% of GDP, due to the significant role played by insurance companies in its health system, similarly to the United States. After Puerto Rico, Chile (4.3%), Colombia (3.2%) and Brazil (3.1%), were the countries that reported the highest penetration rates in 2022, above the regional average of 3.01%.

The density indicator (premiums per capita) were 276.4 dollars, which is a 15.2% increase over the level of the previous year. The significant growth in premiums in the insurance industry in 2022 and the improved performance of exchange rates against the dollar explain this improvement in the level of density compared to the previous year, which already exceeded the pre-pandemic level. A large portion of insurance spending per person in a majority of countries in the region remains focused on the Non-Life segment (159.5 dollars), which was up by 15.6% compared to the previous year. Life insurance density amounted to 116.9 dollars, 14.5% above that of 2021. Between 2012 and 2022, density (measured in dollars) shows a slightly higher level than a decade ago, increasing by 1.0% in that period, after overcoming a downward trend since 2013 this year.

And the insurance depth index in the region (the ratio between Life insurance premiums and total premiums) was 42.3% in 2022, -0.2 pp below the level of 2021. The decline in this indicator in 2022 was due to the better performance of the Non-Life segment, having grown more than the Life segment, which also performed well, despite showing lower growth than the Non-Life business. A country-by-country analysis shows that Argentina, Brazil, El Salvador, Honduras, Mexico, Nicaragua, Panama and Peru showed declines in the indicator in 2021 and 2022. In the medium-term analysis (2012-2022), the indicator for the region shows improvement over the last decade, with a cumulative increase of 0.1 pp in that period.

Chart 3 shows the comparison of the different countries in the region, based on penetration, density and deepening, indicators that measure the level of development of the respective insurance markets.

Chart 3. Latin America: Penetration, Density and Depth Indexes, 2022

(premiums / GDP, %; premiums per capita, USD; Life premiums / total premiums, %)

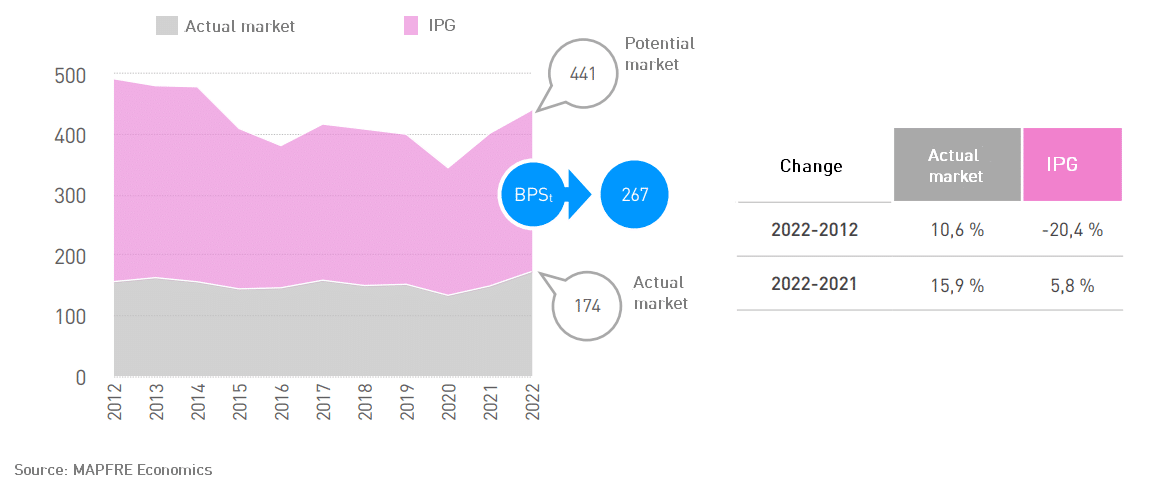

With regard to the Insurance Protection Gap estimate (the difference between insurance coverage that is economically necessary and beneficial to society, and the amount of that coverage effectively acquired) the estimate of this indicator for the Latin American insurance market in 2022 is 267.2 billion dollars, some 5.8% (14.5 billion dollars) more than the estimate in 2021. Because it is a structural measurement, there were no major changes in the composition of the IPG over the last decade compared to our previous report, confirming that the bulk of the gap lies in Life insurance. The potential insurance market in Latin America in 2022 (measured as the sum of the actual insurance market and the insurance gap in that year) was 440.9 billion dollars, meaning 2.5 times the current market in the region (see Chart 4).

Chart 4. Latin America: Insurance Protection Gap and Potential Market

(billions of USD)

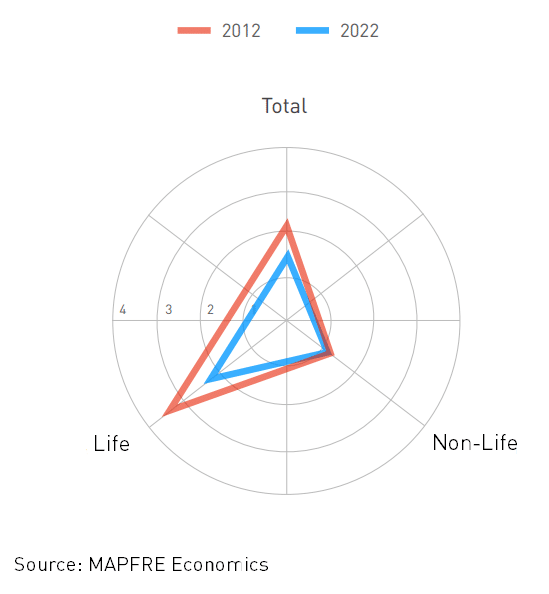

Chart 5 summarizes changes in the IPG as a multiple of the actual market for the Life and Non-Life segments and for the total Latin American insurance market between 2012 and 2022. Throughout this period, there was a reduction in the total insurance gap in the region, measured as a multiple of the real market, especially driven by the decrease in the IPG of the Life segment (the segment with the lowest relative development in the region and, therefore, the highest relative growth). At the same time, the gap of Non-Life insurance showed a smaller reduction in this period.

Chart 5. Latin America: Change in IPG as a multiple of the Actual Market

The full analysis of the structural trends and behaviors of the region’s insurance industry can be found in the report The Latin American insurance market in 2022, prepared by MAPFRE Economics, available at the following link.