Reassessing Pensions Systems

Author: MAPFRE Economics

Summary of the report’s conclusions:

MAPFRE Economics

Pension Systems: An International Comparative Survey

Madrid, Fundación MAPFRE, November 2017

More than a century after the first pensions systems appeared as part of the infrastructure on which the welfare state was built, and after profound transformations in both population dynamics and economic structure, it appears essential to reassess those systems if they are to continue to form part of the institutional framework that gives cohesion to our societies.

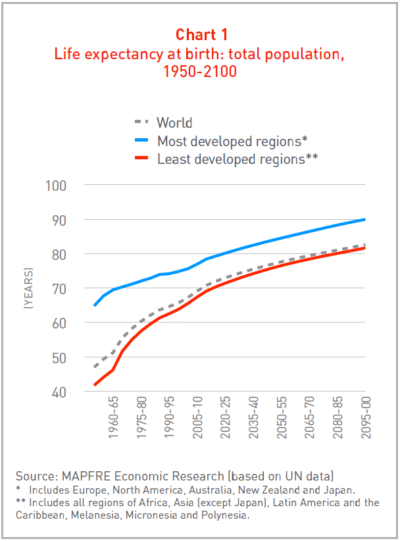

Changes in demographic patterns

Globally, life expectancy at birth has been increasing steadily over recent decades: in 1950 it was 47 years of age, but by 2015 it had risen to almost 71 years of age. This reflects a trend toward greater longevity which, at least in its inertial dynamics, will be maintained in the coming decades both in developed and emerging regions regions of the world (see Chart 1). However, there are scientific investigations in the field of longevity that could result in disruptive changes that would raise the age at death to well above the currently conceivable limits.

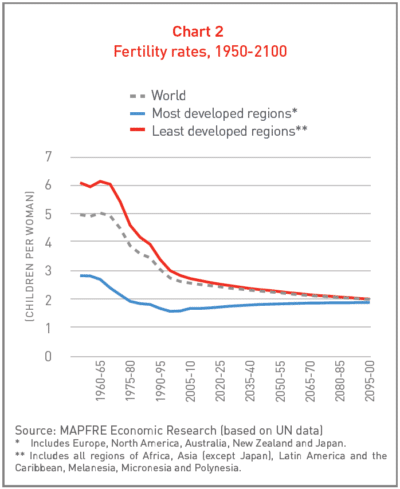

Meanwhile, the behavior of the fertility rate shows a clear downward trend. In 1950, the global average of this index was five births per woman, but by 2015 this had been reduced by half, and it is estimated that by the end of the century it will be around two births per woman, with a convergence of this trend both in the more developed regions and in relatively less developed regions (see Chart 2). Thus, both of these demographic phenomena (greater life expectancy and lower fertility rates) will underpin a process of progressive aging of the population, with more and more people reaching extreme ages.

The effect on the pensions systems

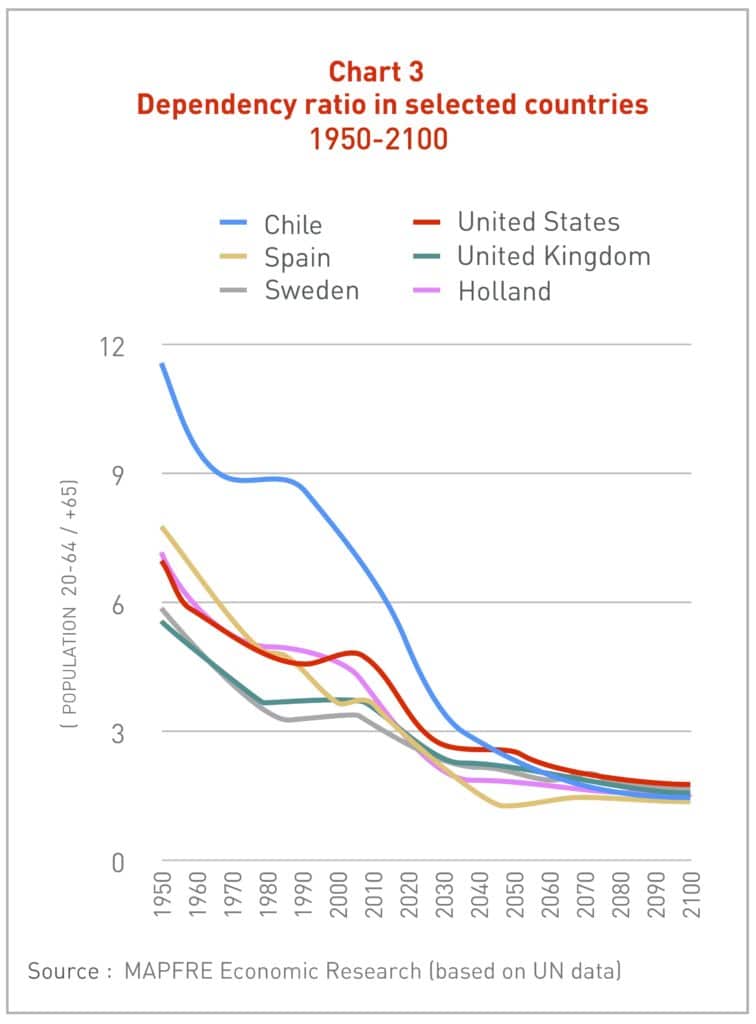

One of the main areas on which these demographic trends will have an impact will be the pensions systems. A first way of measuring this impact is the relationship between the population that has reached retirement age and those persons considered to be of working age (dependency ratio), which has been generally increasing in recent decades. This trend is expected to continue markedly in the coming years.

In Spain, for example, while in 2000 there were 3.7 persons of working age (20-64 years of age) for each person of retirement age (over 65 years of age), it is estimated that by 2050 there will be only 1.3. This is a trend that, with varying degrees of intensity, is seen in all societies globally (see Chart 3).

It is important to note that in addition to the effect of the demographic phenomena, there are economic and financial factors that are also impacting the medium- and long-term sustainability of the pensions systems, such as the climate of low interest rates, as well as others related to structural elements that affect economies’ employment and productivity levels.

Reassessing pensions systems

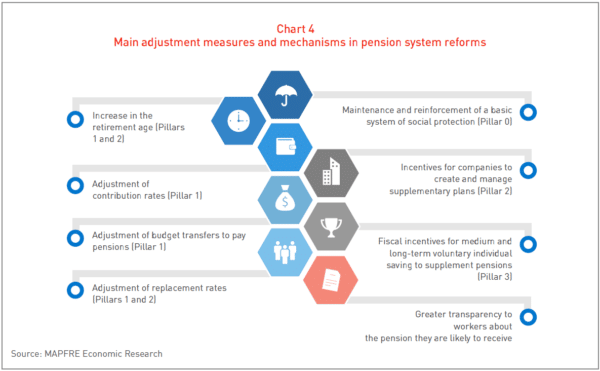

The effect of the demographic, economic and financial factors on the pensions systems can be absorbed or corrected through a combination of mechanisms. Analysis of the international experience suggests that the following are the eight most important public policy mechanisms available to provide long-term stability and sustainability to the pensions systems (see Chart 4): (i) maintenance of a basic social support scheme; (ii) increase in the retirement age; (iii) adjustment of contribution rates; (iv) adjustment of budgetary transfers for the payment of pensions; (v) adjustment of replacement rates; (vi) generation of incentives for businesses to create and manage supplementary pension plans; (vii) establishment of tax incentives for voluntary medium- and long-term individual savings to supplement pensions, and (viii) greater transparency for workers regarding the pension that they will be able to receive in the future.

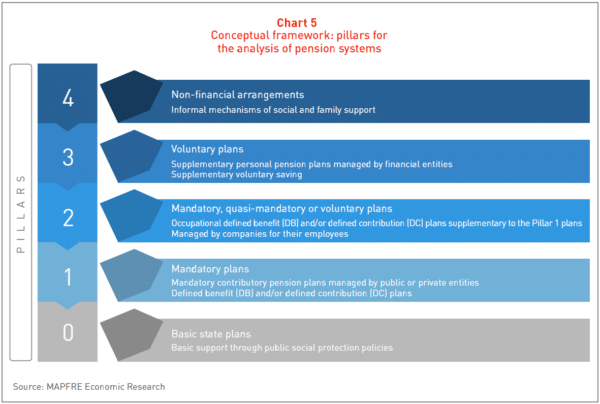

Generally speaking, reforms to systems around the world are based not on the use of any one of these mechanisms in particular, but on a combination of them. However, the use of each of these tools has different effects on the pillars that make up the pensions systems (see Chart 5). For example, the only parametric reform that does not significantly alter the balance between inter-generational solidarity and loss of the level of well-being within “Pillar 1” (compulsory contribution schemes) is the raising of the retirement age. Another important aspect concerns the percentages of contribution to the system. The average for the countries of the Organization for Economic Co-operation and Development (OECD) is around 18%; systems with lower contribution rates can result in replacement rates below that which is desirable. Also worthy of note is the use of targeted tax incentives to stimulate medium- and long-term savings, which have a major influence, particularly when they involve the voluntary individual savings components present in Pillar 2 (occupational schemes) and Pillar 3 (voluntary schemes).

A look at the international experience

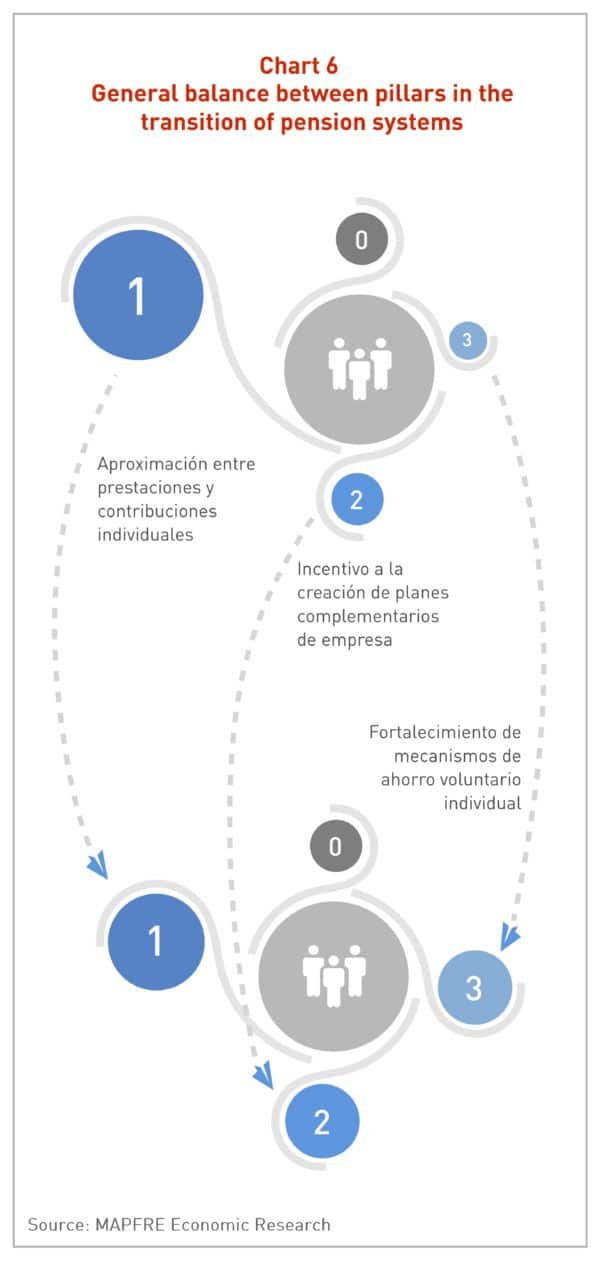

To summarize the international experience, it can be said that the most successful models in terms of counteracting the concrete effects of the demographic, economic and financial risks that affect the pensions systems have been those that have ultimately succeeded in better balancing the relative weight of the different pillars involved in the funding of pensions. In other words, those that have achieved better diversification of the risks to which pensions systems are exposed, by combining the benefits of inter-generational solidarity and stimulus for individual savings (through a restructuring of Pillar 1) and supporting supplementary long-term savings (through a strengthening of Pillars 2 and 3).

Thus, together with the maintenance and rationalization of the Pillar 1 schemes (in both their defined-benefit and defined-contribution variants), a first element of this strategy has consisted of generating stimuli for businesses to create and manage (either directly or indirectly through professional managers) contribution-based supplementary pension plans, and specifically defined-contribution plans. These mechanisms make it possible to stimulate savings by individuals at their place of work, and simultaneously create greater awareness of the importance of medium- and long-term savings, by familiarizing workers with the purpose of the contributions that will fund their pensions.

In the same way, supplementing the funds that will be used to finance the payment of pensions by encouraging the voluntary individual savings that people make through professional managers is an element more suitable for achieving a better balance between pillars, a better system for dispersing the risks to which the pensions systems are exposed, and therefore a mechanism that provides better prospects of sustainability and stability in the long term.As illustrated in Chart 6, from an instrumental point of view, the analysis of the international experience confirms that adapting the pensions systems in order to pursue the objective of giving them long-term sustainability consists of creating a better balance between their pillars (and consequently between their correlative risks). This is a strategy that can only be adopted in a medium- and long-term implementation scenario, and can be summarized in the following general public policy principles:

- Maintenance and strengthening of a basic social support scheme (Pillar 0), i.e. a non-contributory social minimum benefit aimed at those workers who do not succeed in completing the working career that would have given them access to a contribution-based pension.

- Rationalization of a first contribution-based pillar that combines inter-generational solidarity with individual savings, thus bringing the benefits of the system into line with the individual contributions to that system. In this process, measures such as adjustment of the retirement age (which has shown itself to be the measure likeliest to achieve the set objective), together with adjustment of contribution rates, represent two essential tools.

- Generation of stimuli (mainly tax-related) for businesses to create and manage (directly or indirectly through professional managers) contribution-based supplementary pension plans (especially defined-contribution plans) established to supplement the contribution-based pensions of the first pillar.

- Incentivization, through appropriate taxation, of the voluntary medium- and long-term individual savings that people make through professional managers of financial products intended to generate income during retirement as a supplement to the pensions deriving from the first and second pillars.

In conclusion

Adjustment of the pensions systems is a pressing need. This is the economic and social challenge most widely diagnoed by governments, specialists and society; the collective challenge on which there is a large consensus on the urgent need to take measures, and a challenge to which an adequate solution must be found for the sake of key aspects that concern not only countries’ macroeconomic fundamentals but also their social stability.

To achieve this end, it is necessary to reassess the pensions systems of the future in structural terms. A focus based on the risks facing the pensions systems leads to the conclusion that the advance toward a reformulation that provides them with long-term sustainability and stability must center around a better balance between pillars that limits and mitigates the risks inherent in their functioning.

Given the uncertainty regarding the levels of longevity that may result from the demographic patterns of the future, societies and governments must open up a space for reflecting on and implementing measures that will mature only in the medium- and long-term and must therefore be taken as soon as possible. In the end, society cannot rest with the idea of a period of retirement that grows ever closer to the working life of its members; this is not only financially unsustainable, but also – and above all – incompatible with nations’ aspirations for economic and social advancement.

The complete analysis can be found in the Pension Systems: An International Comparative Survey report, prepared by MAPFRE Economics, available at the following link: